|

|

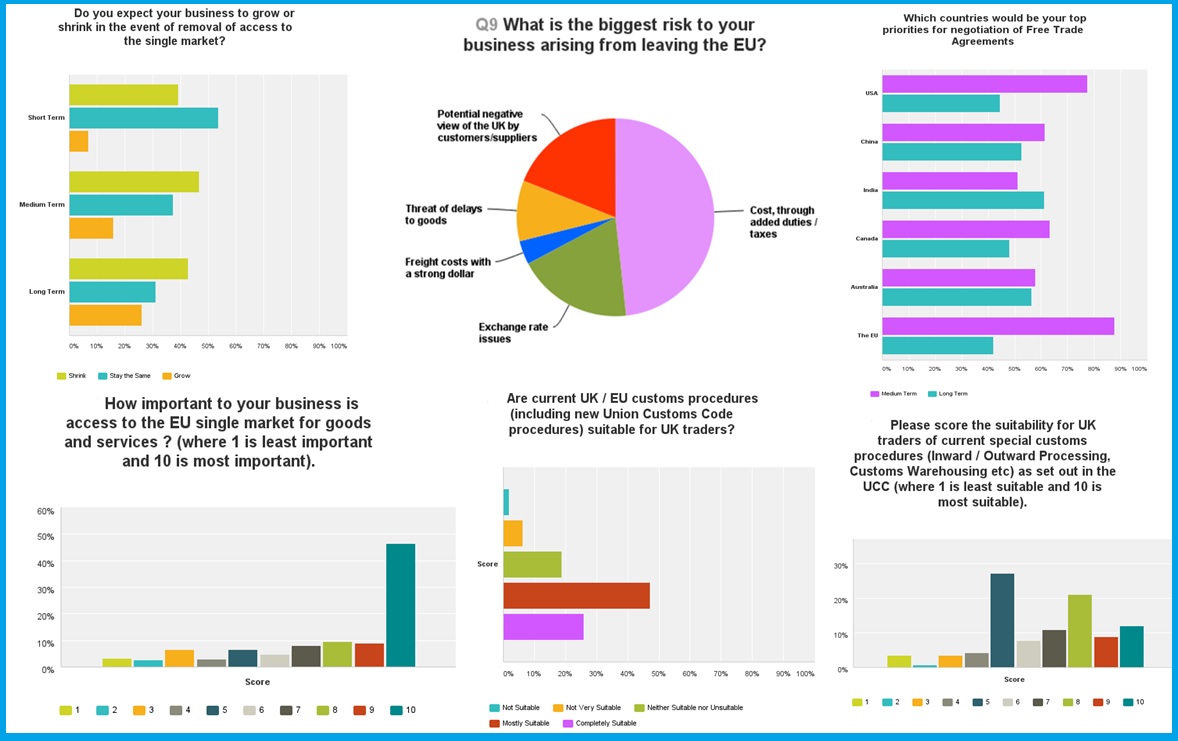

The UK’s exit from the European Union, which could now be delayed until at least late 2019, will almost certainly see the need for new trade and compliance procedures – some of which the IOE will be able to influence. The Institute invited members, established exporters and importers and trade association members to take part in a post Brexit questionnaire and help shape how future trading should work. Responses from over 600 participants from 180 sectors revealed that almost 50% fear the biggest risk post Brexit is added costs through duties or taxes followed by customers and suppliers having a potential negative view of the UK (19%) and exchange rate issues (18%). Further results show that nearly 54% of those surveyed expect their business growth to remain the same with almost 47% projecting growth to shrink in the medium term – and over 42% forecasting a long-term growth decline. Almost 47% of recipients say the current UK and EU customs procedures are suitable for UK traders. When asked what changes and developments they required in their respective business sectors, responses spanned free movement of goods between countries, financial support for new and established exporters – and clear information about regulations. Nearly half rated continued access to the EU single market for goods and services as 10 on a scale where ten is most important, with one respondent reporting that existing EU customers are already becoming reluctant to continue working with them on the same terms, citing the following conversations: Dutch customer – “now you have left the EU we shall not place orders” , Austrian customer – “now you have left and £ is reduced we want 18% price reduction” and another reporting that: “One third of our workforce is foreigners, here legally. Their right to remain obviously will have a massive impact on the business.” When asked how UK export controls and licensing procedures can be made more user-friendly for their businesses, most said they were content with the current system and hoped the arrangements could remain on an EU-wide basis. However, there were calls to streamline the UK’s system – with either IT enhancements or additional support making license application faster and more efficient. The need for help to navigate the procedures was also voiced, with one recipient suggesting, “Workshops, webinars and people to help us through them.” On transit and security arrangements, the importance of any deal negotiated with the EU not having clauses that could delay shipments was also expressed. If the government failed to achieve this, the feeling is that it must proactively prevent UK exporters losing out by committing extra resources to lessen the impact of the new rules and speed up the process. A respondent voiced the concerns of many when they commented: “Our volume of intra EU trade is currently three times the size of our trade to outside the EU so a “hard” Brexit will require significant investment in personnel and systems to ensure we can cope with the increased requirements for export processing.” There was a noticeable difference between the needs of SMEs and larger organisations when it comes to the support they require. SMEs find it harder to access the resources needed to deal with the unavoidable administrative processes necessary to international trade. It is therefore the SMEs, who are the life-blood of UK business, who will feel the hardest impact of any increased financial or administrative burden imposed on the UK as a result of negotiations with the EU. Additional results highlighted that in the medium term, almost 88% saw resolving the UK’s trade relationship with the EU as a priority and that this should be dealt with before trying to enter into any new agreements with other nations or trading blocs. This is unsurprising in that the very nature of modern global trade, with its reliance on international supply chains, means that it would be unlikely that any country would want to commit to new trade arrangements with the UK until it is clear to what extent we will have access to the EU single market. Thereafter Free Trade Agreements with USA (77%), Canada (62%), China (61%), Australia (57%) and India (51%) were seen as important medium term objectives. When asked the same questions about the longer term perspective, India came out on top (61%) followed by Australia (56%), China (52%), Canada (48%), USA (44%) and the EU (42%). IOE Director General, Lesley Batchelor OBE, said: “The results of the survey will inform and influence government and civil servants and we urge businesses to harness trade associations and business groups to continue to make their voice heard, tell them what they need to ensure that they can compete effectively in the global market – and let them know which regulations are stopping them from doing it properly or are impeding their companies’ growth.” The IOE has led the way with ground breaking BREXIT workshops. Launched on 24th June, they are designed to stimulate thought and planning around how this momentum can be harnessed in current markets and with a view to looking at beyond the safety of the EU. The Institute’s world-renowned qualification and training programme projects all businesses forward into a better understanding of world trade – from start-up to larger global traders. Its Technical Help for Exporters Helpline acts as a support or safety net where companies trading with the EU can discuss concerns about the future of their commercial relationships with customers there – and ask what they need to be thinking about now. Lesley Batchelor added: “While our relationship with the EU won’t change overnight – and could now be delayed until 2019 – there is no time to waste as fallout from the vote won’t wait for us to invoke Article 50. For example, many EU clients have profound fears and will need reassuring, while a number of other immediate uncertainties could bring benefits or extra costs – for example, short-term currency fluctuations. “It is vital that businesses are aware of all this so they can resolve problems quickly and capitalise on opportunities.” Our series of post Brexit workshops are helping businesses to prepare for all the possible scenarios and are helping them to plan the next steps to take to spread their risks. Also delivered in-house, on companies’ premises, contact us on +44 (0) 1733 404 400 for more details. If you would like more information on the IOE’s membership, training and qualifications, please visit our website or contact us if you have any questions |

Enter search criteria