With so much being said about Brexit at the moment and the prospect of a no-deal exit from the EU becoming increasingly significant, it’s paramount that UK businesses prepare themselves for the various different situations that potentially loom.

No one knows for certain what will happen with Brexit and the only certainty for UK businesses going forwards is that uncertainty will continue. Businesses can no longer wait and see. They need to plan for a no-deal, ensuring they have an understanding of how customs procedures and checks work in place, in case they become the order of the day in 2019, 2020 or beyond.

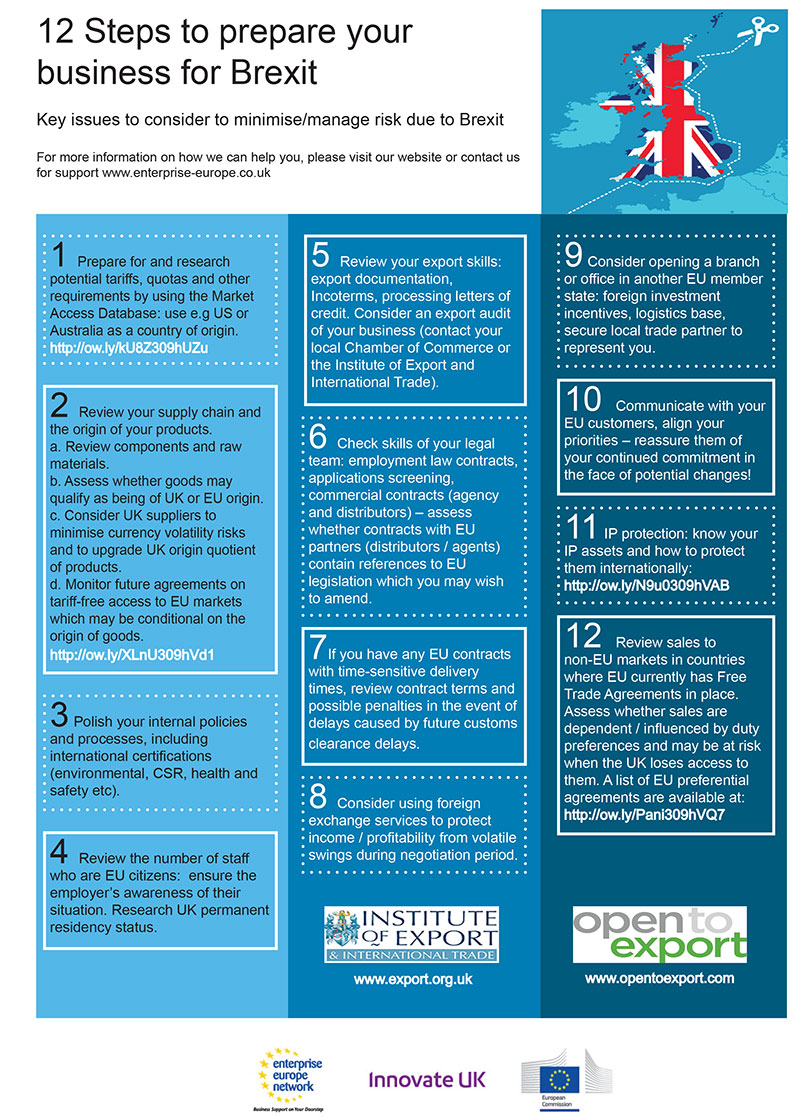

Get started with our Brexit checklist

There are a few things you can do now to prepare your business for the UK's departure from the EU. Our Brexit checklist is a good place to start:

1. UK tariff codes

Identify the UK tariff codes for all your products by searching trade tariffs on the GOV.UK website. Your tariff code allows you to fill in declarations and other paperwork, check if there’s duty or VAT to pay and any potential duty reliefs. You can get advice on how to classify your goods by contacting HMRC.

2. Documents

Identify what documentary requirements might apply for your products when exported to, or imported from EU countries by searching the EU Commission Market Access Database. When choosing a market, you can’t currently select the UK so select either USA or China to understand requirements for a typical non-EU country. You can also access the EU Brexit Preparedness portal, to understand the potential outcomes for your sector.

3. Product "origin"

Check the “origin” for customs purposes of all products when exported to, or imported from EU countries. Identify the UK/EU/non-EU content (including all components and raw materials) and whether your goods may qualify as being of UK or EU origin.We run a one day training course covering Rules of Origin

4. Customs delays

If working in time-sensitive sectors, consider how your EU clients maybe impacted by customs delays (further considerations may include just-in-time practices, timed deliveries and potential penalties and short shelf-life goods).

5. Checks

What level of risk of physical or documentary examination might apply for your goods imported from, or exported to EU countries? Consider the impacts on your business and EU clients.

6. Costs

Identify your EU clients (or suppliers) who are particularly cost-sensitive and might be disrupted by extra costs for import duties, customs clearance costs, higher freight costs, or currency fluctuations.

7. Staff risk

How many of your staff are EU nationals? What is the level of risk if they leave and how might it impact on your business? Any risk areas identified around skills and language?

8. Cash flow

Consider cash-flow risks if VAT on EU imports becomes payable at the time of importation instead of via Intrastat. Also consider protecting against foreign exchange fluctuations within your business.

9. Employment law

Identify and consider employees who are based permanently or temporarily in EU countries. What are the employment law implications for them and the business?

10. Free Trade Agreements

Identify exports to countries which have Free Trade Agreements (FTAs) with the EU. Are they dependent on duty preferences or other Free Trade Agreements (FTAs) provisions? Consider the implications, especially where main competition is with other EU businesses. Access details of which countries have Free Trade Agreements (FTAs) with the EU

11. Purchases

Identify purchases from other countries which have Free Trade Agreements (FTAs) or Generalised System of Preferences (GSP) agreements with the EU. How significant is this in the sourcing decision?

12. Supplier declarations

Identify sales to EU clients who incorporate those goods into their products, for re-export to countries with Free Trade Agreements (FTAs). Check whether supplier declarations are provided.

13. Licensing controls

Are your goods subject to export or import licensing controls?

14. Authorised Economic Operator status

Is your business an Authorised Economic Operator (AEO)? Consider the benefits of applying for this. Find out more in our AEO guide.

15. Intellectual property protection

Consider the impact of Brexit on intellectual property (IP) protection. Read the Protecting your UK IP abroad guide for hints and tips on managing this.

Most importantly, communicate with your EU customers (and suppliers); align your priorities and reassure them of your continued commitment in the face of potential changes.

This checklist is taken from our Post Brexit Planning Workshop - a one day training course to help companies be aware of the potential impact that Brexit may have and the best way to prepare for them.