Almost half of respondents taking part in the Engineering Industries Association’s latest survey have experienced a rise in demand for exports across the past six months and are more confident about their business prospects.

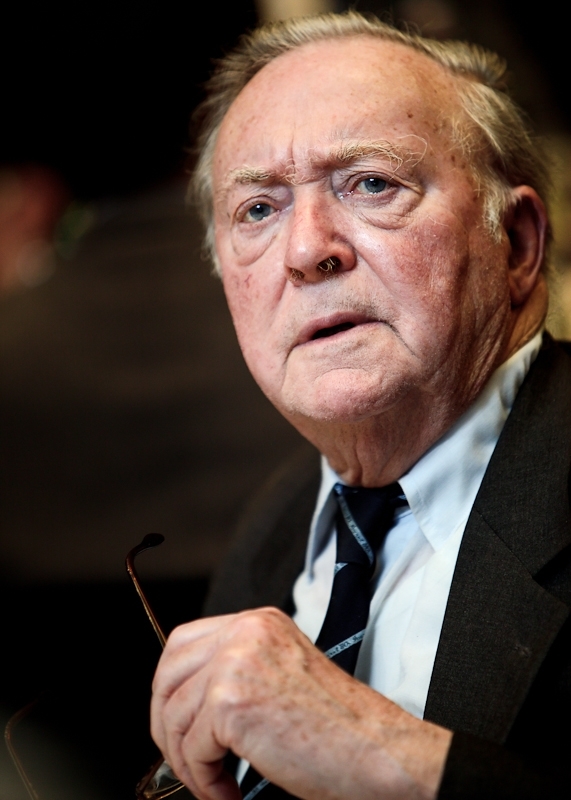

The SME survey from IOE Trade Association member, the EIA, is distributed twice yearly to EIA and IOE members on behalf of EIA President, Sir Ron Halstead, and forms part of a larger Bank of England survey into the current economic and financial prospects for SME’s.

The key findings revealed:

•Business confidence remains positive – 49% stated that their overall business confidence is higher than when last surveyed, 33% felt it remained the same and 18% felt that it was lower.

•Growth continues to be good – 47% expected growth to increase, 40% anticipated that it will remain the same and 13 % predicted a decline.

• UK demand remains the same as last time.

•Export demand is stronger – 61% expected export demand to increase, whilst only 25% felt it would remain flat and 7% thought it would be weaker.

•Employment figures were expected to remain mostly static at 53%, although 42% expected figures would rise

• The average pay increase is expected to be between 0-2% and 2-4%.

•Over 53% are experiencing noticeable skill shortages within their business.

•31% of respondents will increase prices (excluding VAT), down from 51% previously.

However, whilst there is a feeling of positivity towards business confidence, there continues to be ongoing problems for SME’s with regards to securing funding for their businesses, particularly for investment and growth. Many think that the big 4 banks still have a negative attitude to lending to SMEs, and are more interested in selling them their services, rather than helping them with their finance.

There is likewise a feeling among many that the bank referral scheme, which forces banks to find alternative lenders, is not working. They say that Government finance schemes such as Funding for Lending and Finance for Export are not being promoted by the banks and that SMEs are not being encouraged to use them.

This has resulted in many SMEs operating within their own cash flow or obtaining additional funds from shareholders, alternative lending providers, family and friends or even re-mortgaging their homes when the need arises for finance, investment, and business expansion.

The British Business Bank (BBB) is seen as a welcome step forward and is helping the alternative lending market, which is expanding but it is still relatively small.

The BBB is supporting the innovative finance provider URICA who help UK companies with early invoice payment without any of the security requirements of a bank. They also take the responsibility of collecting customer payments whilst insuring the risk of trading overseas.

URICA, in cooperation with the EIA, is able to offer over £100 million for EIA members to support their business.

Respondents also reported problems with receiving payments from larger company clients, with many holding on to the payment for extended periods, which significantly affected SME cash flow.

The consensus of this latest study is that whilst business confidence was good and export demand was predicted to increase, the strong pound has adversely affected potential export markets and the ongoing EU discussion is not helpful for long term investments. This, combined with the lack of support from the banks, presents findings which whilst encouraging, still have plenty of room for improvement.

Pictured: EIA President, Sir Ron Halstead

For more information on the IOE’s business membership, training or qualifications visit our website or contact us