A royal occasion unsurprisingly requires a meal that’s fit for a king, and King Charles III and the Queen Consort, Camilla, have chosen a ‘coronation quiche’ ahead of tomorrow’s historic ceremony.

The Royal Family website has described the meal as a “deep quiche with a crisp, light pastry case and delicate flavours of Spinach, Broad Beans and fresh Tarragon”.

Since it was announced, many of the country’s chefs and food retailers have been buying in the right ingredients or trying to make the most of the export opportunities around this now world-famous recipe.

Classified: coronation quiche

As ever, if importing or exporting ingredients, identifying the correct commodity code is a key step in the trading process and is a requirement for completing customs declarations.

Lyn Dewsbury, a customs and trade specialist at the Institute of Export & International Trade (IOE&IT), has been using the government’s online tariff tools to find the codes traders could use if looking to export or import ingredients for the royal quiche.

This article is for educational and entertainment purposes only. It does not constitute legal advice on any of the commodities included.

Shop-bought quiche

A food retailer may want to export or import ready-made coronation quiches to sell to those of us who aren’t prepared to don our aprons and get in the kitchen.

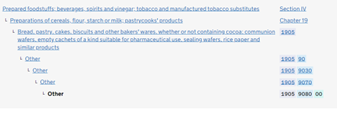

Using the UK Integrated Tariff tool online, Lyn suggests that you could use the following code for exports 19059080, with 00 added at the end for imports.

Using the tool, you’ll see that the Most Favoured Nation (MFN) tariff is 8%, but under the EU-UK Trade and Cooperation Agreement (TCA), there is a preferential tariff of 0%.

MFN rates apply when preferential tariffs aren’t or cannot be claimed – for instance, when the UK doesn’t have a preferential trade agreement with a country.

Buying ingredients

There are various recipes online for the quiche, including this one on Culinary Ginger. Below, Lyn has looked at some of the commodity codes for the main ingredients listed in this recipe. She gives the MFN and TCA tariff for each.

- Milk or cream - 04021019(00)

- MFN rate: £99/100kg

- Quota: £39.75/100kg

- Preferential TCA rate: 0%

- Spinach – 07103000(00)

- MFN rate: 14%

- Preferential TCA rate: 0%

- Flour - 11010015(00)

- MFN rate: £143/1000kg

- Preferential TCA rate: 0%

- Cheddar cheese: 04069021(90)

- £139/100KG

- Preferential TCA rate: 0%

- Tarragon - 07099990(90)

- MFN rate: 12%

- Preferential TCA rate: 0%

- Eggs (hens) - 04072100(00)

- MFN rate: £25/kg

- Preferential TCA rate: 0%

- Broad beans: 07135000(90)

- MFN rate: o%

- Preferential TCA rate: 0%

- Ready-made pastry: 19049080(00)

- MFN: 8%

- Preferential TCA rate: 0%

Other preferential tariffs

You should note that different preferential rates may apply for other countries the UK has preferential trading terms with.

For example, for tarragon, the UK has set a tariff for developing countries of 8.5% through the Generalised System of Preferences (GSP).

The EU’s GSP continues to be applicable for trade between the UK and the developing countries in the scheme, but this will be replaced by the UK’s new Developing Countries Trading Scheme (DCTS) at some point this year.

Quotas – where countries limit the amount of a particular commodity being imported at a preferential tariff – can also apply for some of these goods, including milk, cream, cheese, eggs and pastry.

SPS checks

Several of the goods included above are also subject to additional sanitary or phytosanitary (SPS) controls.

For example, if exporting a ready-made quiche to the EU, a Common Health Entry Document (CHED) may be required. A phytosanitary certificate may also be required for some of the plant-based ingredients, for instance, tarragon.

The government has been introducing SPS controls on EU goods entering Great Britain in stages, following Brexit. Under the draft of the Border Target Operating Model, published in the Spring, many of the remaining SPS controls from 31 October 2023.

Getting more information

You should always ensure you have reviewed your compliance requirements before importing or exporting goods.

For more information about SPS controls, we’d recommend signing up to our SPS training course or consultancy support. You can also watch our webinar about the new draft TOM here.

For more guidance on customs classification, you can review our ‘How to classify your goods’ course, which looks at the principles and rules of classification in depth, or the ‘Customs procedures and documentation’ course, which covers classification within the wider context of the various skills and expertise needed to comply with customs requirements.