Valentine’s Day is a day of romance for many and an opportunity to treat your loved one to some chocolates, flowers and wine.

For many shops across the country, it’s also an important retail event.

Given the UK is largely an importer rather than a producer of wine, flowers and chocolate, it’s also an important trade event.

For instance, the UK is the world’s fourth largest importer of cut flowers, importing £953m worth of them in 2021, according to Trade Economy. The UK also imported around £3.4bn worth of wine that year, with the majority coming from the EU (£2.3bn), according to Statista.

Brexit and Valentine’s

Commodity codes don’t often make for the ideal icebreaker on a Valentine’s date, but for importers they’ve become increasingly important.

Post-Brexit, importers have been required to comply with new customs requirements for the goods they import from the EU, including completing declarations. As part of this, they need to know the correct ‘commodity codes’ of the goods they are importing.

So if you’re importing cut flowers from the Netherlands, chocolates from Belgium or Prosecco from Italy, you’ll need to know your commodity codes.

Why commodity codes matter

Commodity codes are used to track the goods that enter Britain for statistical and duty collection purposes. They need to be included on all customs declarations, irrespective of whether a preferential tariff is being claimed under the terms of one of the UK’s trade deals.

For imported goods, this figure is 10 digits long, comprising of the internationally standardised HS code (first six digits) and four additional digits set at the EU or national level. The UK’s commodity codes remain aligned with the EU’s, for the time being, at the eight-digit level, with digits 9 and 10 set nationally. You should note that for exports, there are often only two additional digits, so the code may only be eight digits long.

The first six digits are found within the World Customs Organization’s (WCO) Harmonized System (HS) nomenclature. The HS consists of 5,000 commodity groups, each identified with a six-digit code consisting of the chapter in which they are listed (the first two digits), the heading under which they can be found (digits three and four) and two further digits where the goods are listed under a sub-heading.

Identifying the correct commodity code for your products – also known as ‘customs classification’ – is therefore an essential task for any importer.

Classifying Valentine’s gifts

The IOE&IT Daily Update spoke to Lyn Dewsbury, a customs and trade specialist at the IOE&IT, about how to identify the correct commodity codes for a range of Valentine’s gifts.

Using the UK’s Integrated Online Tariff tool, she helps us to identify the commodity codes for chocolate bars, wine, prosecco, flowers and the various giftsets you can buy for Valentine's Day.

Chocolate bars

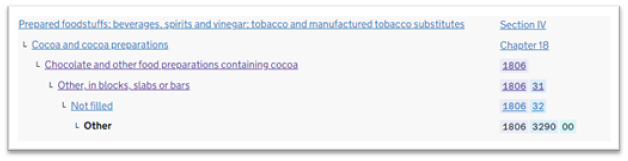

The commodity code for chocolate bars imported into the UK could be 1806329000, she says. This breaks down as follows:

- 18 – HS code chapter number

- 06 – HS code heading number

- 32 – HS code sub-heading

- 90 – set by the EU (with which the UK’s codes are currently aligned)

- 00 – set by the UK for imports

Using the UK Integrated Online Tariff, you can find this code and identify that the Most Favoured Nation rate of duty is 8%, but if importing the chocolate bar from the EU, you can claim a preferential tariff of 0%,” says Dewsbury.

The Most Favoured Nation rate is the rate of duty that the UK levies against countries that are members of the World Trade Organization (WTO) and with which the UK does not have a trade deal.

The UK’s trade deal with the EU – the EU-UK Trade and Cooperation Agreement (TCA) – supersedes the MFN rate that the UK sets with the WTO. The importer will need to indicate that it is claiming the preferential rate from the TCA when completing the customs declaration for the chocolate, and will need to use the correct commodity code to do this.

Prosecco

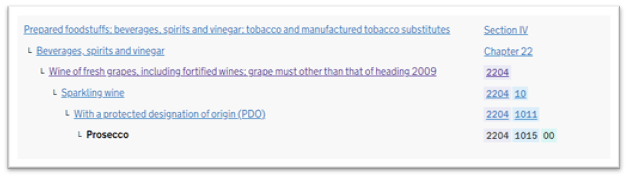

If importing a bottle of Prosecco from Italy, the code will be 2204101500 (see below).

Because Prosecco is a sparkling wine, the code differs at the sub-heading level to a non-sparkling white wine, for which the code could be 2204309800, depending on the alcohol percentage or production process, among other things.

“You should be aware that there is an additional excise duty to pay if importing Prosecco rather than white wine,” says Dewsbury. “Under the TCA, if you’re importing white wine from France, you will be able to claim a preferential duty. However, if importing a Prosecco from Italy, then you may be charged an excise duty of around £28.74/litre.”

Roses

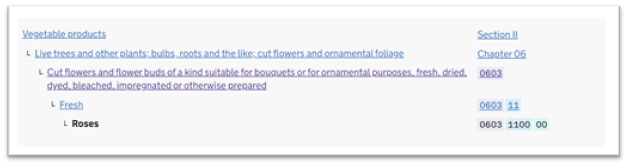

If importing roses, the commodity code to use will be 0603110000. The MFN rate for these is 8%, but the preferential rate is 0% under the TCA (and in other UK free trade agreements).

“Trade deals can make a big difference to your costs as an importer,” says Dewsbury. “For instance, the UK’s imports 9% of its cut flowers from Kenya, making the UK-Kenya Economic Partnership really important because it allows British importers to claim

a preferential tariff and not have to pay the 8% tariff that would otherwise be payable.”

Giftsets

Many romantics will not be content with just buying their partner just one of the above gifts, so how do commodity codes work when you’re importing a giftset containing multiple commodities?

Within the HS nomenclature, the WCO includes six general rules of interpretation (GIRs) for traders to use when deciding between available commodity codes. Dewsbury explains that one of these rules can be used to classify a giftset containing a bottle of wine, a small box of chocolate and a single rose.

“The third GIR – or GIR 3 – can be used when there are multiple items classified under two or more headings,” she explains. “For example, GIR 3(b) asks you to identify which item gives the giftset its ‘essential character’.”

“So, in this instance, you can say that the bottle of wine is the commodity which gives the giftset its ‘essential character’ because its being accompanied by just a small box of chocolates and only one rose,” she explains.

Further support

Dewsbury says that, for new traders, the six GIRs and classification as a whole can be difficult to understand initially.

“Classifying certain types of commodities or combinations of them can become complex,” she says.

It’s for this reason that the IOE&IT runs multiple training courses covering customs classification.

This includes the bespoke ‘How to classify your goods’ course, which looks at the principles and rules of classification in depth, and ‘Customs procedures and documentation’, which covers classification within the wider context of the various skills and expertise needed to comply with customs requirements.

For more information about the IOE&IT’s suite of training courses, visit https://www.export.org.uk/page/training