Lá Fhéile Pádraig sona duit! Or happy St Patrick’s Day to our readers less acquainted with the Irish language.

Celebrated by people of Irish descent around the world, St Patrick is probably one of the most famous patron saints of any nation.

Intriguingly, however, the first St Patrick’s Day parade is thought to have taken place in the US rather than Ireland, according to parade.com. That said, the day is well celebrated in Ireland, with a four-day festival taking place annually in Dublin.

St Patrick was thought to have introduced Christianity into Ireland in the fifth century, but the celebration in his name is now probably more closely associated with a pint of Guinness, dying rivers green and wearing novelty hats.

Following our recent features on St David’s and Valentine’s days, the IOE&IT Daily Update here looks at the commodity codes you’d be needing to use if trading such goods internationally, with the support of IOE&IT trade and customs consultant Lyn Dewsbury.

Exporting a Guinness

Guinness is drunk all over the world and the UK is unsurprisingly the biggest market for the dry stout.

More surprisingly, perhaps, is that Nigeria is the third biggest market for the drink, ahead of the US and Cameroon in fourth and fifth, according to The Drinks Business.

So what commodity code would you need to use if exporting Guinness to Nigeria?

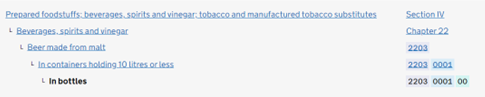

It’ll probably be easier to do so in bottles, so the commodity code you could use for bottled Guinness with about 4.2% alcohol is 22030001(00).

Using this code on the government’s online tool for checking duties on exports, you’ll see that the UK does not have a preferential trade agreement with Nigeria and so trade is done using the Most Favoured Nation (MFN) rates Nigeria has set at the WTO.

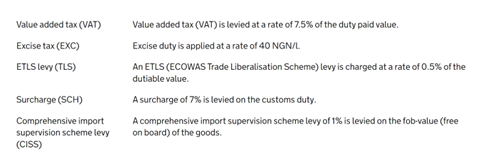

This means a 20% duty will be chargeable against bottles of Guinness imported into Nigeria, alongside other charges (shown below).

Furthermore, according to gov.uk, “it is sometimes necessary to show a certificate of origin for goods, even when non-preferential rules of origin apply”.

IOE&IT would therefore suggest that, if you haven’t exported to Nigeria before, you get advice from a customs expert before doing so. Business members of the IOE&IT can call the IOE&IT’s International Trade Helpline for guidance while non-members would benefit from the IOE&IT’s training and consultancy services.

Exporting green dye to the US

The St Patrick’s Day celebration in Chicago is among the most famous in the world, largely because the main river flowing through the city is died green to mark the occasion.

If a UK exporter of green pigment dye won a contract to supply the dye for the Chicago parade, what commodity code would they need to use?

Using the tool on gov.uk, you’ll see that you could use the following code: 32041790, though an additional two digits may be determined by the US customs authorities.

It’s likely that an MFN rate of 6.5% of the FOB (free on board) price will be chargeable, with other potential taxes and charges listed in the tool.

Importing novelty hats from Ireland

You may also be a UK importer wanting to sell novelty St Patrick’s Day hats to mark the occasion.

Searching for novelty hats using the UK Integrated Online Tariff tool, you’ll see that a code you could use for this is 6505009090.

The UK’s MFN rate for imports of this commodity is 2%, but under the EU-UK Trade and Cooperation Agreement you could apply a 0% preferential tariff, provided your goods comply with the agreement’s rules of origin requirements.

Importing Waterford crystal glasses

Beyond St Patrick’s Day, you may just be interested in importing some of the top quality products that are produced in Ireland, including Waterford crystal glasses.

Using the UK Integrated Online Tariff tool again, you’ll see that a code you could use to do this is 70134190000.

Under the UK’s MFN schedule, a 10% duty would apply, but you can again claim a preferential tariff of 0% under the terms of the EU-UK Trade and Cooperation Agreement, provided you comply with the deal’s rules of origin requirements.

This article is for educational and entertainment purposes only. It does not constitute legal advice on any of the commodities included.