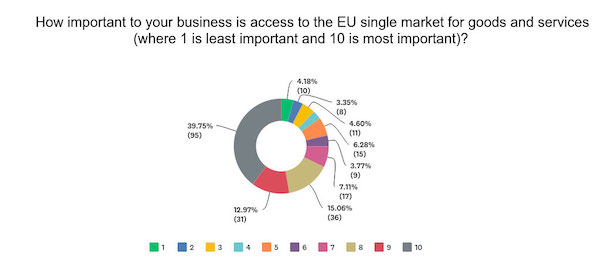

2 years on from the referendum on the UK’s membership of the EU, it remains the case that many UK exporters desire continued membership of the single market. 39.75% of respondents in our recent Brexit survey said that the single market had the highest possible importance, scoring it 10 out of 10 in our poll, up from 33.6% last year. Those saying that membership in the single market was 7 or more out of 10 was up slightly from 73.76% to 74.89%. Only 15.06% rated it at 4 or lower out of 10. 52.3% or respondents said that government should prioritise access to the single market as part of their negotiations.

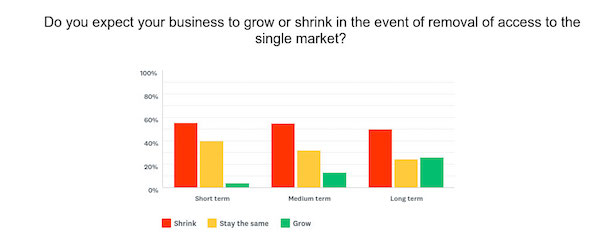

The impact of leaving the single market would see a majority predicting their businesses to shrink in the short and medium term. 55.65% predicted their business would shrink in the short term, with 55.23% saying the same in the medium (again around the same as last year’s scores of 54.46% and 53.47%). 49.49% predicted long-term shrinking, though 25.94% saw long-term growth which is again around the same as last year’s 25.25%.

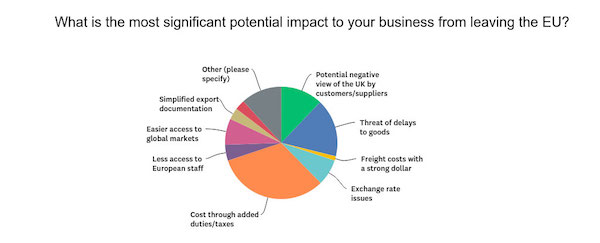

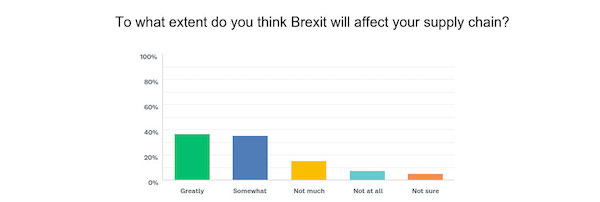

The impact of leaving the single market would be mostly felt through the impact to business’ supply chains through additional costs added in taxes and duties and potential delays to goods. 36.82% predicted that their supply chains would be greatly affected, while in response to a question about what the most significant impact of Brexit would be, 32.22% said costs through taxes and duties (compared to 27.23% last year) and 16.74% said delays to goods.

Businesses are planning ahead, but not as much as last year

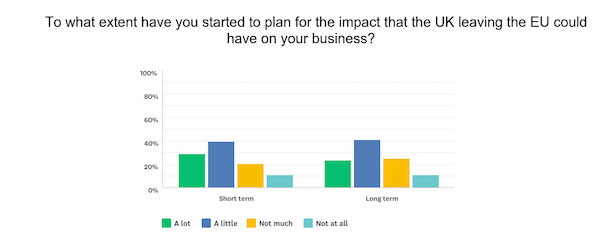

Businesses, generally speaking are planning for the short and long terms impacts of Brexit. 31.53% are not planning at all or very much in the short term, with 35.58% saying the same in the long, with 68.47% planning a lot for the short and 64.41% for the long.

However, this is down from last year, where only 26.53% said they hadn’t planned at all or not very much in the short term, and only 30.11% said the same in the long-term.

Given the stated importance of the single market for many of these businesses, it is not surprising that companies are looking to plan for the impact of lost access to it.

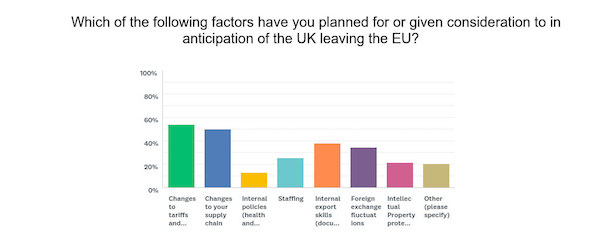

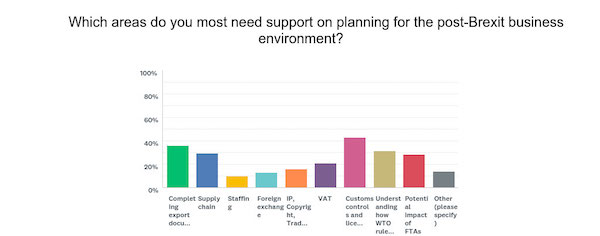

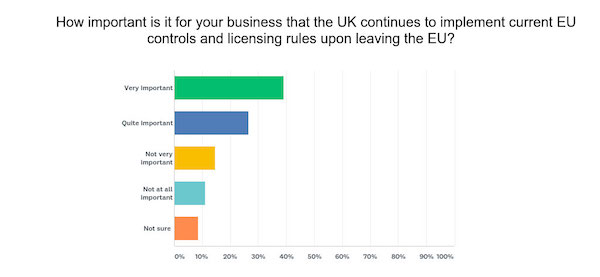

54.05% said they were planning for changes to tariffs and quotas with 50% saying they were planning for supply chain changes. And in terms of where companies require support in their planning for the impact of Brexit, 43.24% said they needed support for customs controls and licensing, 36.04% for export documentation, and 31.53% for understanding how WTO rules work.

Companies predicting rough waters ahead

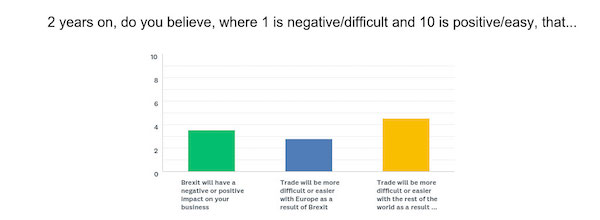

The overall effect of all this is that companies are predicting Brexit to have a generally negative impact on their business.

32.03% said that Brexit was going to have the utmost negative impact - i.e. 1 out of 10, where 10 is positive - with 61.31% scoring 1-3 out of 10. This figure was 39.84% for trade with the EU and 37.89% for trade beyond the EU, but there was more positivity for trade beyond the EU with 29.3% scoring a 6 or more out of 10.

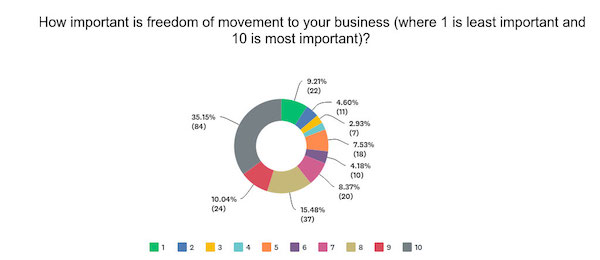

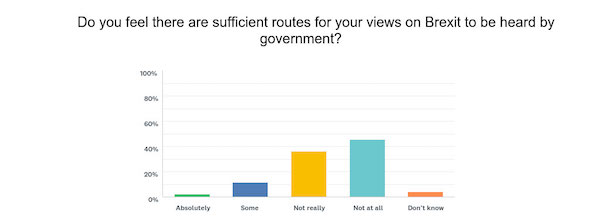

With freedom of movement also being something that the businesses polled valued - 69.04% scored continued freedom of movement as having 7 or more out of 10 in importance with 35.15% saying 10 - there was generally a feeling of helplessness about where the negotiations are currently going, with 81.51% saying they didn’t have sufficient routes to government to voice their concerns and views about Brexit.

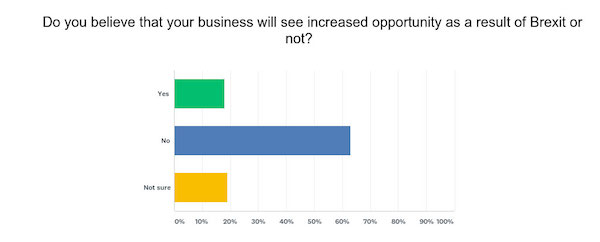

Overall this has seen 62.89% saying they do not see any potential for increased opportunity after Brexit, though 17.97% saw the brighter side of things.

Positivity about Global Britain

In terms of those who are more positive about Brexit, several respondents did say that there would be less bureaucracy involved in doing trade, more opportunity to trade outside the confinements of the EU, greater capacity to negotiate trade deals with non-EU markets, greater democratic control over our trade policies, and greater control over tariffs.

This positivity about 'Global Britain' was reflected in the long-term view that India, China and Australia should be the markets that the government prioritises signing new deals with, though the EU was viewed as being the most important short-term trading partner.

Please continue giving feedback!

As ever Brexit remains a divisive topic with a broad spectrum of opinions and views involved.

Please feel free to continue to feed back your views - positive, negative or wherever they sit in the ‘robust national debate’.

Selected respondent comments

- The clock is ticking and we know not what to plan for...it’s all theoretical and not based on solid fact or reality; customers in the EU are in exactly the same position...business needs to plan, it’s not politics but the day to day reality of commercial life and running the economy…

- We export over 90% (35% EU). The main worry is the level of uncertainty, delays, costs and wrong decisions we may make.

- At the moment, whilst all the answers I have made reflect our current view point, they may well change once we see the final exit plan form the EU

- We are entering the unknown in the short term but medium and longer term the sky could be the limit. exchange rates will have a major bearing on our competitiveness abroad

- The EU has been stifling us. Incidentally how can any organisation not be able to get its accounts signed off every single year? Secondly the EU regulations are a mockery as they are not enforced, For years I have tried to have Cebit organisers bring in a system to make sure the goods offered for sale into the EU comply with the regulations. I have emailed the EU bodies and no one tasks any interest. A very large number of exhibitors do not have CE, RoHS or Reach and when I ask about this they cannot understand why. I am told no one else asks. The UK should maintain these regulations on leaving, we should make importing non compliant products far harder and I have suggestions that would help. With EU imports we should not assume that they comply many will not. It is a completely false premise to believe that all EU products meet these regulations. So when the stifling effect of the EU is removed that drains our resources we will have a very good future and better product, environment and animal welfare to look forward to.

- Regulatory differences between the UK and EU will add costs in order to sell our medical devices into the EU and other countries that base their regulatory systems on the EU system

- There is a need for customs processes for EU shipments both inbound and outbound and also impact of UK departure in EU countries. We cannot afford to be parochial on this we have to look at the whole supply chain

- Politics trumping Economics. A successful UK after Brexit will be perceived as a political threat to the EU (if the UK is not joined to the EU in some way) so they will work hard to stop the UK being successful.

- We are now less than a year from leaving the EU, and still no clearer to knowing what 'Brexit' means. All we can say is that exporting will become more difficult. To export to the EU we will have to abide by the rules of the EU, but as a non member have no say in their formation. Please also note that in Scotland 60% voted to remain in the EU and that Holyrood voted against the EU withdrawal bill. It is deeply frustrating that the tories are determined to jump of the Brexit cliff, and that labour are doing nothing to stop them.