HM Revenue & Customs has published a customs information paper on processes for exports from Great Britain from 1 January 2022.

The paper, published 20 December 2021, outlines the technical processes for exporting goods from GB to the European Union from 1 January 2022, as per the UK’s Border Operating Model.

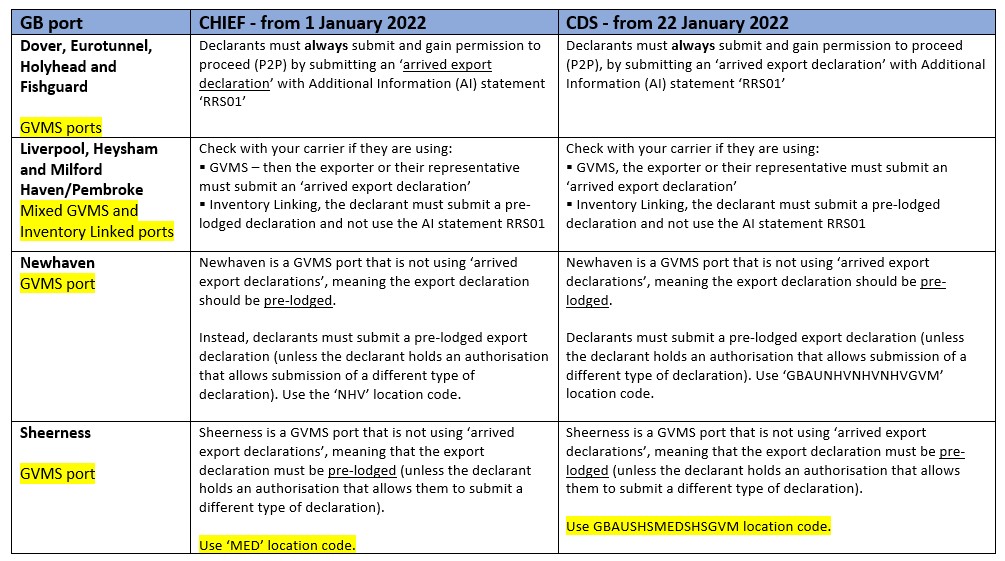

A key message is that GB exporters need to ensure they identify the port through which their goods will leave GB – as the process to be followed will vary port-by-port.

Processes will vary depending on:

- whether the port is using government IT platform GVMS (Goods Vehicle Movement Service) or inventory linking systems

- whether export declarations are being lodged on CHIEF or CDS customs declaration systems.

You can see the list of ports using the Goods Vehicle Movement Service here.

Customs processes

Details of the technical requirements at certain ports are summarised in the table below:

Download a high resolution pdf of this table here.

Physical inspections

For goods moving through Dover, Eurotunnel or Holyhead, the declarant will need to tell their haulier to present the goods at the nearest inland border facility.

For goods moving through Liverpool, Heysham, Milford Haven/Pembroke or Fishguard, the declarant will need to tell their haulier to present the goods at the port’s designated customs checking facility.

As this has the potential to delay

goods, exporters are recommended to ensure they have worked with their haulier to understand what paperwork may be needed ahead of any physical inspection.

Ports using GVMS

Hauliers will need to provide the carrier/vessel with a goods movement reference (GMR) number. This GMR links declaration references together for a specific vehicle or trailer. GMRs are valid for each crossing and can only be used once.When the AI statement ‘RRS01’ has been declared (see table), this indicates that declarations need to be submitted via GVMS. Failure to provide the ‘RRS01’ statement within the declaration will result in GVMS not being able to arrive the declaration.

Actions to prevent delays from Jan 2022

- Identify the port through which your goods will leave Great Britain

- Check the summary table above and ensure your carrier or haulier is aware of the process to be followed, especially if they need to register for GVMS and lodge a GMR for the goods movement

- Check your customs broker is aware of the need to declare the ‘RRS01’ statement on the export declaration if goods are travelling through one of the named ports

- Contact IOE&IT for further assistance here.