The government has today (18 November) announced a further extension to certain sanitary and phytosanitary (SPS) checks for EU goods entering Britain.

The UK has been introducing import controls on EU goods entering Great Britain in phases since the start of 2021 as part of its post-Brexit ‘Border Operating Model’.

This contrasts with exports to the continent which have been subject to customs formalities since the end of the transition period.

Goods moving into Northern Ireland have been subject to differing rules under the Northern Ireland Protocol.

SPS delays

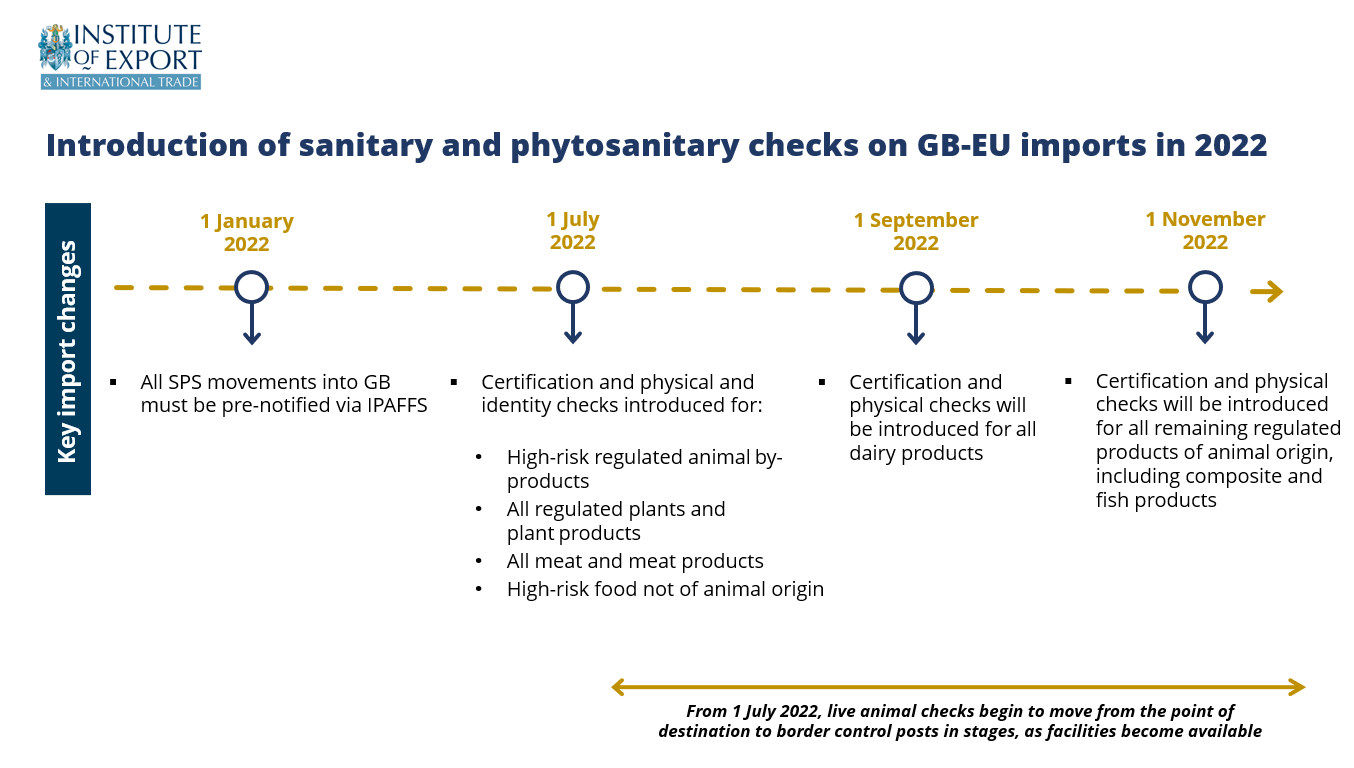

In its latest update to the Border Operating Model – now called the ‘The Border with the European Union’ – the government has announced that certification and physical checks will be introduced for products of animal origin, animal by-products, plants and plant products in phases from July 2022.

- Phase 1 – 1 July: high-risk animal-by products, all regulated plants and plant products, all meats and meat products, high-risk foods not of animal origin

- Phase 2 – 1 September: dairy products

- Phase 3 – 1 November: all other regulated products of animal origin including composite and fish products

The requirement to pre-notify the Animal and Plant Health Agency (APHA) or Department for Environment, Food & Rural Affairs (DEFRA) of imports of SPS goods from the EU, using IPAFFS (the import of products, animals, food and feed system), will still come into force from 1 January 2022.

(Download high res pdf of the above infographic)

Documentary checks include the requirement of export health certificates for products of animal origin. These certificates must be approved by an official veterinarian in the EU.

Phytosanitary certificates will be required for plants and plant products.

Declaration requirements

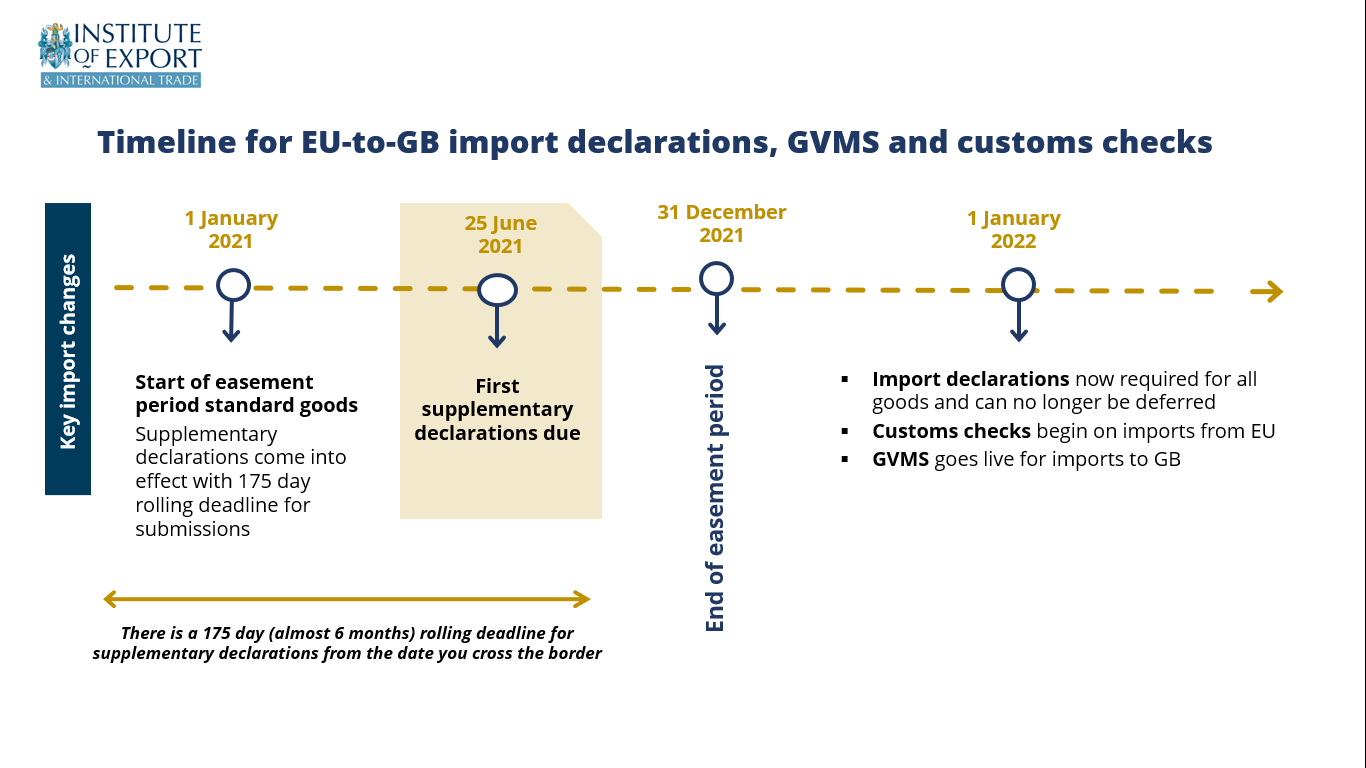

The latest update does not affect the timeline for when import declarations will become required for all imports in to Britain, which was last updated in September 2021.

According to this timeline, import declarations will be required for all imports, at the point of goods entering GB, from 1 January 2022.

This will put an end to an easement that has been in place since the end of the transition period that has allowed importers to delay completing declaration requirements until 175 days (or roughly six months) after the goods arrived in Britain.

(Download high res pdf of the above infographic)

Goods Vehicle Movement Service

From the start of next year, the government’s Goods Vehicle Movement Service (GVMS) will go live and will become a requirement for ports that are operating a ‘pre-lodgement model’ for checks on imports.

Under this model, hauliers will need to pre-lodge declarations for the goods they are carrying into Britain, using GVMS, to generate a Goods Movement Reference number. Hauliers will not be allowed to board any ferry heading to a British port adopting the pre-lodgement model if they do not possess a GMR.

Other ports will be adopting a temporary storage model whereby customs formalities are completed for the goods entering Britain while they are in storage at that port for a maximum time of 90 days.

Clock is still ticking

Speaking about the latest change to the government’s post-Brexit border controls for imports, IOE&IT Academy director Kevin Shakespeare warned traders that they still need to prepare for import declarations from the start of next year.

“Although we welcome further clarity from the government on the introduction of SPS checks, we must continue to urge businesses to prepare for import declarations on 1 January,” he said.

“If you’re not ready, we urge you to look at the training and consultancy support from the IOE&IT on completing declarations,” he added.

BOM support

The IOE&IT continues to deliver a suite of training and consultancy around the new rules for importing goods from the EU that are due to come into effect next year. You can find out more about this here.

The IOE&IT is also running a free webinar with Digital Trader Services on Thursday 25 November about how importers can make use of origin rules to avoid possible duty payments on imports from the EU. You can sign up to this here.