Traders have been able to receive and send goods and components throughout the COVID-19 crisis, analysis of a coronavirus impacts tracking survey by the IOE&IT has found.

Cash flow worries have also receded for exporters and importers throughout the pandemic, but declining overseas demand and rising freight prices have become major concerns since lockdown began on 23 March.

The findings come from a weekly Coronavirus Impacts Tracker conducted by the IOE&IT during the first 10 weeks of lockdown in the UK.

High response rates

The IOE&IT Coronavirus Impacts Tracker, where the same questions are being put to attendees of weekly webinars hosted by the IOE&IT, had average response rates of more than 50%.

The webinars had on average 300-plus attendees, with more than 800 attending the ‘COVID-19: Export Controls and Licences’ webinar on 22 April.

Declining demand

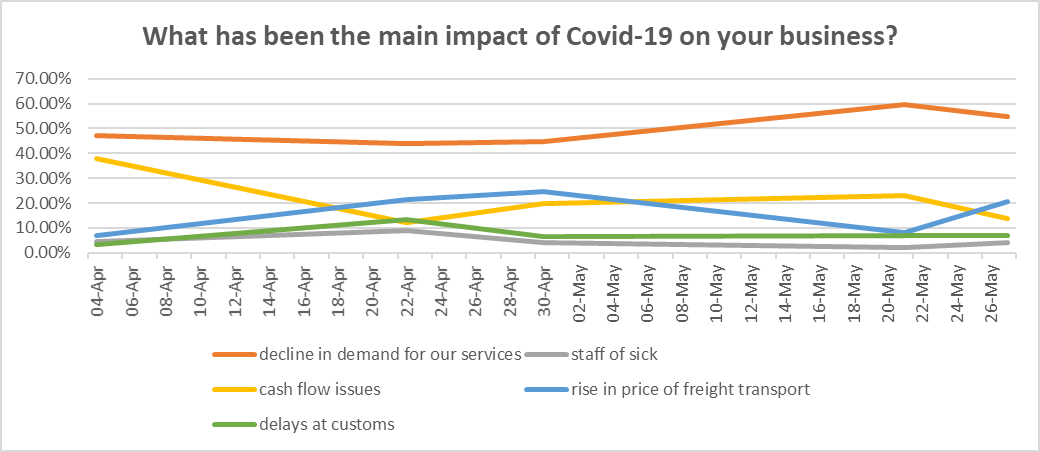

Across the ten weeks, ‘decline in demand for our services’ has been the main consequence of the virus for companies trading internationally. On 4 April, nearly half (47.13%) of the attendees picked this as the chief impact, but by 27 May, declining demand had risen to 54.7%.

Source: IOE&IT Coronavirus Impacts Tracker

Cash flow

‘Cash flow issues’ were cited as the second highest impact (37.93%) on 4 April, but this problem declined to 13.7% when tested on 27 May, by which time access to government support programmes had been improved after early criticism.

Delays to goods

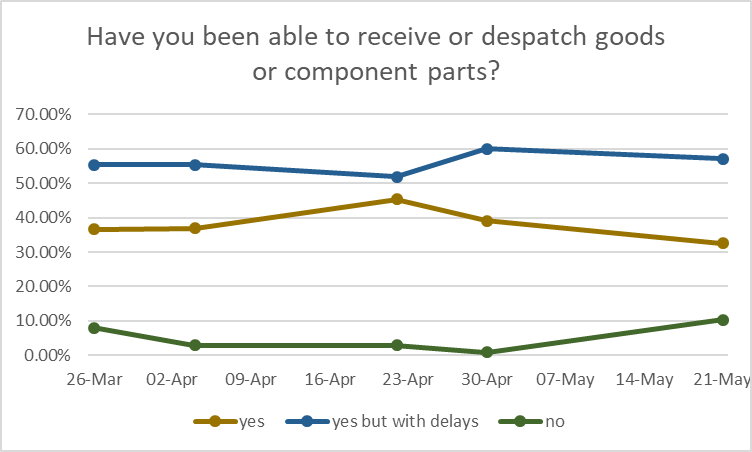

A consistent positive for traders responding to the tracker survey has been their ability to receive or despatch goods or components across borders throughout the pandemic. At the same, however, they have admitted delays.

In response to the question ‘Have you been able to receive or despatch goods or component parts?’, the number of respondents saying ‘yes but with delays’ has been consistent, coming in at 55.4% at the end of March and 57.1% in mid-May.

As of 21 May, the proportion of respondents unable to receive or send parts stood at 10.4%, up from almost zero on 30 April.

Nearly a third (30.5%) said they were continuing to receive or despatch goods without delays as of 21 May.

Source: IOE&IT Coronavirus Impacts Tracker

Non-essentials bear the brunt

Kevin Shakespeare, director of stakeholder engagement at the IOE&IT and a regular speaker on both webinar programmes, told the Daily Update (4 June) that sectors selling non-essential goods and services have been particularly hit by the virus.

“One of the unfortunate consequences of COVID 19 has been a decline in demand for what are termed non-essential goods and services, for example supply chains to the airline and automotive sectors, leisure and tourism along with demand for energy commodities,” he said.

On the “dramatic increase in the cost of air freight” he said there is particular concern for goods exporters who are “reliant on fast delivery times”, including those selling on ecommerce and involved in ‘just-in-time’ supply chains.

However, he said the way in which internationally trading businesses are adapting to the pandemic “is to be admired” and the industry as a whole, including trade financers and the banks, is “to be congratulated”.

Webinar programmes

The Open to Export and UK Customs Academy webinar programmes are typically attended by a wide range of individuals and businesses involved in international trade, from small businesses to large corporates.

There have been 10 webinars across the Open to Export and UK Customs Academy platforms since the lockdown was introduced in mid-March, which have been attended by over 3,000 people with many more watching the recordings online.

Open to Export is a free information service from the IOE&IT dedicated to supporting businesses new to international trade.

The UK Customs Academy was set up by the IOE&IT in partnership with KGH Customs Services at the request of HMRC to bolster the UK’s customs intermediary sector ahead of the end of the Brexit transition.