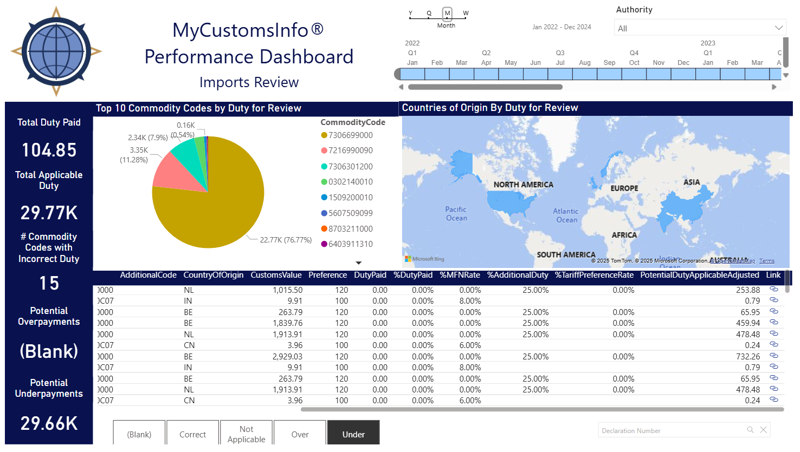

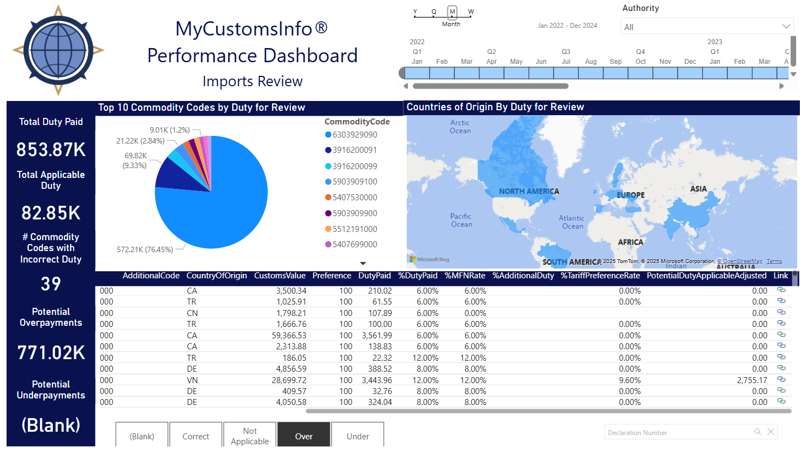

MyCustomsInfo empowers your business to proactively identify duty overpayments and underpayments.

Correcting underpayments reduces the risk of fines and helps your business maintain HMRC compliance. Meanwhile, identifying duty overpayments preserves your business’s cash flow and profitability.

With analysis tools, document storage and a status dashboard, MyCustomsInfo is the essential online solution to ensure customs compliance.

MyCustomsInfo is available as a standalone platform or as an integrated system as part of our advisory services.