Article by: Ted Winterton, UK CEO of Bibby Financial Services

The latest SME Confidence Tracker Report has been issued by IOE&IT Corporate Member Bibby Financial Services (BFS).

The first Confidence Tracker Report of this year, released in April, showed that notable progress between the Government and the EU throughout March had resulted in rebounding confidence amongst the UK’s small and medium sized businesses.

However, less than three months later, the Government’s plans are in disarray following the resignation of Brexit Secretary, David Davis and Foreign Secretary, Boris Johnson. While quickly replaced by respective successors, Dominic Raab and Jeremy Hunt, changes yet again leave Theresa May’s tenure as Prime Minister on shaky ground.

With repeated calls for Article 50 to be extended to enable tangible progress to be made in negotiations between Brussels and the UK Government, the future of Brexit is now more uncertain than ever. This will undoubtedly impact SME sentiment over the summer months.

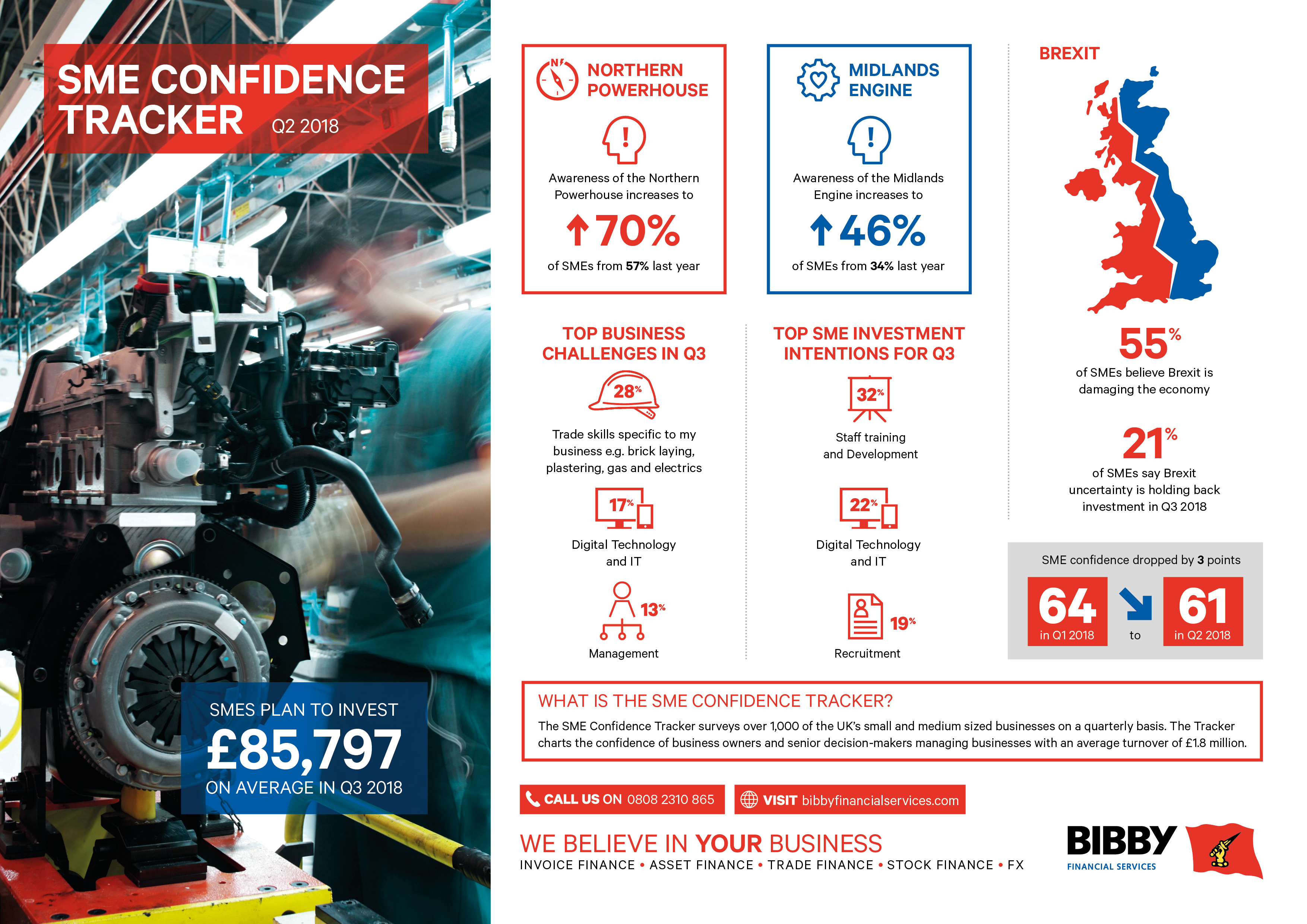

Prior to July’s Cabinet changes, however, SMEs had already indicated their frustration over a lack of further progress on Brexit, following a seemingly positive start to the year. The BFS Q2 2018 Tracker data reveals confidence yet again tumbling between April and July as one-fifth of SMEs reflected that Brexit uncertainty was holding-back investment and stifling growth plans.

The proportion of businesses not planning to invest over the coming months has jumped by 10 per cent from over a quarter in Q1 (28%) to almost two-fifths (38%). Average planned investment has dropped significantly with SMEs planning to invest £85,797 between June and September, down from £103,648 planned for Q2. Sales expectations for Q3 have also taken a hit. More than one in ten businesses (12%) now expect sales to decline in the next three months, up from 7 per cent in the first quarter of the year.

Key findings:

- SME confidence dropped by 3 basis points from 64.7 in Q1 to 61.3 in Q2 2018

- Over two-fifths (42%) of SMEs expect sales to increase in Q3 2018, down from 50 per cent in Q2 2018

- SMEs plan to invest an average of £85,797 in Q3

- Three-fifths of SMEs (62%) expect to invest in their businesses in Q3, an decrease of 10% from Q2.

- Awareness of the Northern Powerhouse has increased to 70 per cent of SMEs from 57 per cent in Q2 2017

- Awareness of the Midlands Engine has increased to 46 per cent of SMEs from 34 per cent in Q2 2017