The vast majority of UK traders listening to an IOE&IT webinar today (10 March) said they have not yet registered to the EU’s new systems for VAT accounting.

On 1 July 2021, the EU introduced new VAT rules for trade into and within the bloc.

This included the scrapping of the low value consignment relief for goods valued under €22 and the introduction of two new portals for accounting VAT: the Import One Stop Shop (IOSS) and the One Stop Shop (OSS).

Majority

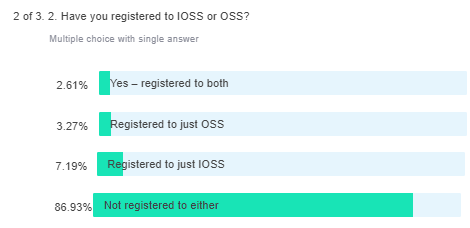

The majority (87%) of listeners on the webinar said they had not yet registered to either portal.

Only 3% had registered to both, with 3% having signed up to just OSS and 7% to just IOSS.

Portals

Businesses sending goods into the EU from non-EU countries (including Great Britain) must comply with new import VAT requirements using the new IOSS system.

To register on IOSS, businesses must hire or already have fiscal representation in one of the EU member states.

The OSS has been set up for businesses trading within the EU.

Choppy waters

Paul Woodward, the trade and customs specialist presenting today’s webinar, said it was not surprising that not many businesses had registered to either portal yet due to the challenging trade environment and the complexity of VAT.

“It’s choppy waters in international trade right now, with the changing regulations like plastic packaging, the end of the pandemic and with VAT being so complex, so it’s perhaps not surprising that traders haven’t registered to either portal yet”, he said.

“There are additional costs that come with getting a fiscal representative, so it’s not a shock,” he added. “With a lot of these portals and compliance requirements, people do not want to make mistakes in regard to VAT.”

Compliance

Although most businesses hadn’t signed up to either portal, most said they were aware of how to comply with the new VAT rules.

Just under half (48%) said they were ‘moderately aware’ and 12% said they were ‘fully aware’. Just under a fifth (19%) said they weren’t ‘fully aware’ and 9% said they were ‘not at all aware’. The remainder (13%) said they weren’t sure.

Woodward advised businesses to understand how they will go about compliance, however.

“Traders need to understand what they need to do, which portal they need to use, how to use it and what the best process for compliance is,” he advised.