Most businesses are not yet using the government’s new system for submitting export declarations despite a looming deadline coming up this autumn, a poll on a webinar from the Institute of Export & International Trade (IOE&IT) has found.

The Customs Declaration Service (CDS) has been being introduced in phases over the last few years. It replaces the Customs Handling of Import and Export Freight (CHIEF) system which had been in use for over 30 years.

It has been compulsory for importers to use CDS for declarations since autumn last year, but the deadline for exporters to start using the new system was extended to 30 November 2023.

Not ready yet

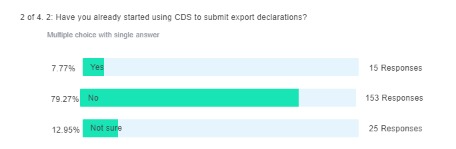

On a free IOE&IT webinar informing exporters about what they need to do to migrate from CHIEF to CDS yesterday (15 March), only 8% of the delegates said they were already using CDS for export declarations. The vast majority (79%) said they are not yet using CDS, with the remainder (13%) saying they were unsure.

Just under half of the audience said they felt either ‘very prepared’ (10%) or ‘quite prepared’ (38%) to start using CDS for export declarations, however, around two fifths said they felt ‘not very prepared’ (31%) or ‘not at all prepared’ (10%).

Teething issues

Importers are now required to use CDS, with CHIEF closing for import declarations last year, but Matt Vick, a trade and customs consultant at IOE&IT, said there “were problems” with the new system.

HMRC extended the switchover deadline for importers that encountered technical issues submitting declarations on CDS just days before CHIEF was due to close on 30 September 2022.

Vick said many businesses had experienced difficulties registering to CDS and that some of the features of the new system weren’t working as anticipated.

This informed HMRC’s decision to extend the deadline for exporters to 30 November, Vick said. The original deadline had been the end of this month (31 March 2023).

Extension unlikely

However, Vick said the government is unlikely to extend the deadline for exporters again.

“A lot of people have asked the question, will the exports deadline be delayed, like with the imports switchover.

“We can’t predict the future, but we’re assuming the government wants to stick to the current dates – the switch to November was already a significant extension.

“They’ll need to see what progress they make resolving some of the issues on the import side, but I think the government would say that businesses have had plenty of time to get ready for this transition. Businesses have known about this switch for over a year.”

Vick added that exporters can make use of the IOE&IT’s training and consultancy support to get ready for the CDS switchover.

Getting ready

On the webinar, most delegates (56%) said that they file declarations using an intermediary, with only a quarter (25%) self-filing and under a tenth (7%) doing a mixture of the two.

Sam Blakeman, a product marketing manager at Customs4trade, who also spoke on the webinar, said it was important that traders test submitting declarations using CDS, whether they self-file or submit via an intermediary, in advance of the deadline.

“Speak with your software provider if you’re using one. They should be providing you with a plan as to how the process of moving you over to CDS will work.

“If you’re using an agent, they will be doing the same with their provider and should be able to give you an idea as to when they’ll look to move you across and what additional information they might need.”

“A final key thing is to test all those information flows thoroughly,” he added. “The more testing you do, the better.”

Cutting-edge solution

A message from Customs4trade, IOE&IT’s event partner for yesterday’s webinar:

“If you are looking to revolutionize your business's customs management, look no further than Customs4trade (C4T).

“With our cutting-edge CAS technology, you can automate and streamline your customs compliance. Say goodbye to costly administrative tasks – with C4T, you can reduce these expenses up to 90%. By bridging the gap between businesses and customs authorities, we're revolutionizing the world of international trade.

“Contact us today and experience the power of true customs management automation.”

For more information, visit: http://www.customs4trade.com