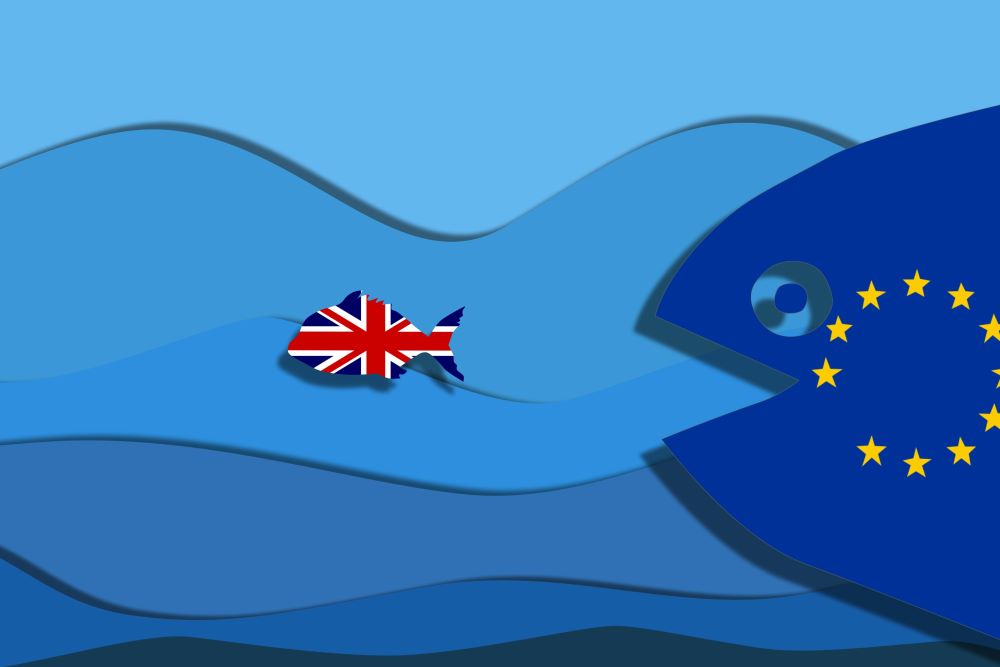

France may look to block the official signing of the UK and EU’s Memorandum of Understanding (MOU) on future cooperation over financial services in response to the ongoing dispute over fishing rights.

The MOU was announced in March and covered future dialogue between the UK and EU on the vexed issue of how much access UK-based firms should be granted to European financial markets post-Brexit.

Though the terms of the agreement have been fully negotiated, the EU has not yet made the MOU official.

Fishing dispute

French officials are now considering not signing off on the MOU, according to City AM.

They may stall the EU’s authorisation of the agreement until a resolution is found on access for its fishermen to waters just off Jersey, which is a British Crown Dependency.

Tempers flared last week between London and Paris over the dispute, with the British government even sending Royal Naval ships towards the island following French threats to cut off power supply.

Beyond France and fish

According to the Daily Mail, France will delay approving the financial services deal until Boris Johnson grants European fishermen fair access to UK waters.

“We’ve made a link between the two,” its source said.

Another source said Britain was failing to adhere to the terms of the deal governing its post-Brexit trade ties with the EU that was agreed at the end of last year.

“It’s not just France and it’s not just fishing,” said the European diplomat. “Britain must fully apply the agreements it signed up to, which is not the case right now.”

London’s loss

Financial services were not covered in the UK-EU Trade and Cooperation Agreement deal and UK-based firms have been granted only limited access to European finance markets while they await a deal on equivalence.

This has caused some investment banks to accelerate the pace at which they are moving their senior staff from London to financial centres across the European Union.

Chaperone

Client-facing bankers in London now need to have a ‘chaperone’ based inside the bloc whenever they speak to clients. This new requirement has spurred some firms to relocate staff into Europe.

However, while banks like Morgan Stanley, Barclays and Goldman Sachs are beginning to move more staff over to Europe, the Covid-19 pandemic and uncertainty over the future prospects of a UK-EU deal for the sector slowed down any predicted ‘exodus’ immediately following the end of the transition period on New Year’s Eve.

Exodus or a trickle

A predicted exodus of financial jobs from the capital has so far been a relative trickle, with only around 7,600 moving up until March, according to research from consultancy EY reported in Yahoo Finance.

European Central Bank’s bank supervisor, Andrea Enria, this month said that he understood the pandemic had slowed down relocations, but he stressed banks need to ensure people in charge of interactions with European clients are inside the bloc.