Most businesses are not yet ready to start using the government’s new IT system for customs declarations, a poll today (23 August) has found.

The Customs Declaration Service (CDS) is replacing the Customs Handing of Import and Export Freight system (CHIEF) in phases, with CHIEF closing for import declarations on 30 September.

From this time, traders will only be able to submit declarations for imports using CDS.

Readiness

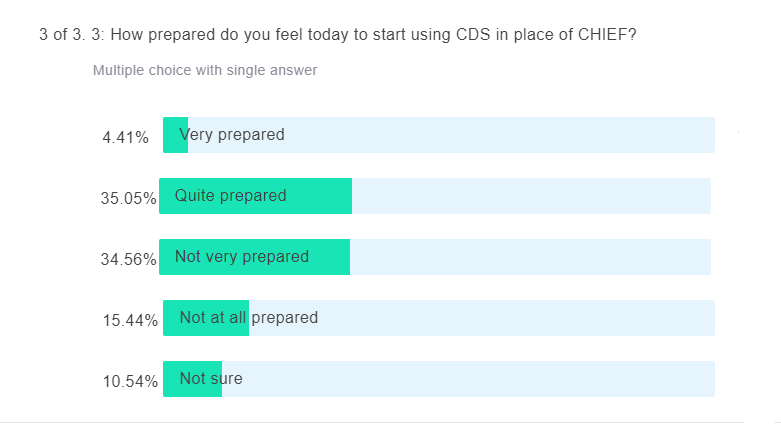

On a webinar from the Institute of Export & International Trade (IOE&IT) about how traders can prepare for the new CDS system, half of the attendees said they were either not very prepared (35%) or not at all prepared (15%) to start using it.

However, more people said they were either very or quite prepared (40%) than when a similar webinar was hosted in May this year, when only 22% of delegates said they were ready.

Get ready

IOE&IT customs and trade specialist Matt Vick, who was speaking on the webinar, said the shift since May was positive, but that more traders needed to get ready.

“It’s good to see that there is a shift towards more firms being prepared,” he said. “But for those businesses that are feeling less prepared, make sure to attend more webinars like this one, and to look into the support available from both HMRC and the Institute.”

"While the change to CDS will require some adaptation from businesses, in the long term it’s a platform that many may find more accessible, with greater potential to grow alongside the government’s ambitious border plans," he added.

Support package

During the webinar Vick mentioned the IOE&IT’s CDS support package, which puts together a range of solutions to help traders to start using the new service.

The package includes a new CDS helpdesk, expert-led one-day training courses, CDS trade surgeries and consultancies, as well as answers to traders’ frequently asked questions.

Rehearsal service

The CDS service has been running concurrently with CHIEF for both imports and exports for some time already.

A ‘Trader Dress Rehearsal’ service is also available for businesses and their intermediaries to get used to the new system.

CHIEF is due to close for export declarations from 31 March 2023.

“For those that haven’t used CDS yet, you should definitely look at the dress rehearsal service,” said Vick. “If you’re using a third party software for your declarations, there’s also a good chance this is already integrated with CDS, so there’s no reason why you can’t get started today”.

Shift

When asked if they were already using CDS to submit declarations, just under a fifth (19%) said they were, with two thirds (67%) saying they weren’t and the remainder saying they were “not sure”.

This marked a small shift since May when three quarters (75%) said they hadn’t used CDS yet, with only 9% saying they had and the remainder (16%) saying they weren’t sure.

Dialogue key

Vick explained that many of the delegates who responded “not sure” were likely to be those hiring intermediaries to complete declarations on their behalf.

Two thirds of the audience said they used intermediaries to complete declarations, with only 15% saying they ‘self-filed’ declarations. Just under a tenth (9%) said they both used intermediaries and self-file.

Opportunity

Vick noted that the switch to CDS was being viewed by many businesses as an opportunity to bring declaration submission in-house, or at least as a chance to increase their own awareness of customs processes.

He advised that the liability for providing accurate information to customs authorities, through declarations, is ultimately held by the importer and exporter.