The Institute of Export and International Trade (IOE&IT) recently ran a series of free webinars designed to get more businesses exporting.

Under the scheme, businesses from across the UK were invited to attend six webinars, covering all the key aspects of trading with the EU. Feedback from the course was overwhelmingly positive, with 95% of participants saying they found the programme satisfying and informative.

During the webinar series, participants were asked several poll questions about trading challenges, knowledge and use of free-trade agreements (FTAs) and their confidence and experience of various aspects of trade and customs procedures.

Who were the delegates?

When asked about their experience in exporting, over half (56%) said they were exporting to some degree, either describing themselves as experienced (16%) or exporting, but keen to do more (40%). Just shy of 10% said they used to export but didn’t now, while over a third (34%) were new to export.

Given the scope of the voucher scheme, which was heavily skewed towards trade with the EU, it was not surprising that when asked which markets they were selling to, the EU was by far the most popular choice (89%), followed by Asia and Australasia (combined at 54%) and the Americas (53%). Just under a third (31%) were exporting to Africa.

The biggest macro challenges

Given the wide range of markets they supply, it was inevitable that macroeconomic challenges are preying on exporters minds. Again, given the EU focus of much of the course, it wasn’t entirely unexpected to see Brexit ranked as the most significant factor having an impact on trade. It was cited by over half of respondents (54%), almost twice as many as those who selected the pandemic (23%) as the most important factor and almost five times the number selecting the war in Ukraine (11%).

And the UK government’s chances of rebooting the economy through its Autumn Statement were not highly rated by delegates. With chancellor Jeremy Hunt trying to recover some ground lost by the disastrous Mini Budget in September, we asked exporters what impact they expected the Statement to have.

The vast majority (88%) said it would have no impact or a negative impact on their business. Only 12% thought the impact would be positive. This was despite almost half (45%) of delegates answering in another question that they had been badly affected by recent swings in the value of pound sterling.

But there remain more fundamental, micro challenges for trading companies. Asked which barrier was most preventing them from exporting more or to more markets, complexity of trading rules was cited as the number one obstacle, with 57% saying this was their main challenge. And the not unrelated issue of the administrative burden of trade was cited by a further 16% of respondents, with market access and tariffs also mentioned (9% and 7%).

FTAs

This leads on naturally to consideration of FTAs and their impact on trade. The Department for International Trade (DIT) recently announced a shift in emphasis away from doing more deals to making sure existing FTAs were being more fully utilised.

The evidence from our polling confirms this is the right approach, with almost two thirds (63%) of respondents unclear if they were benefiting or not from the EU-UK Trade and Co-operation Agreement (TCA) and 74% feeling the same about agreements with non-EU countries.

Further, when asked how well equipped they feel to maximise the value of FTAs, only 42% of respondents felt “quite” or “very” confident they had the knowledge needed to benefit from current or future deals. Over half (51%) “not very” or “not at all” confident.

Specific trade and customs knowledge

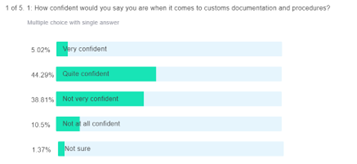

When asked to explain their current customs documentation knowledge, as you might expect from the range of delegates on these webinars, there was a wide spread of levels of confidence. While only 5% declared themselves very confident, a further 44% were quite confident, with a similar number (49%) declaring themselves not very or not at all confident.

Slightly more confidence was evident when the delegates were asked about their level of understanding of customs regulation, with 8% declaring they had a strong and detailed understanding and 55% having some understanding. The value of the course in helping to build business confidence to trade was highlighted by the fact that during the first webinar, almost a third (32%) declared that they had no or only a superficial understanding.

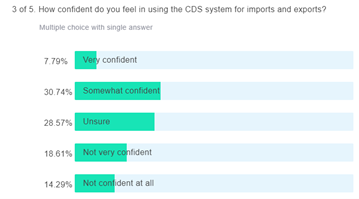

Confidence levels were lower when delegates were asked about the specifics of the new Customs Declaration System (CDS), with less than 40% feeling any confidence at all in using the system. Over 60% were not sure or not confident. Things were better when delegates were asked about their knowledge of Incoterms, with over 60% claiming to have a strong understanding.

A similarly high proportion (58.7%) expressed confidence the art of customs classification, with 61% knowing the correct commodity codes for all the products they trade. At the same time, it was a little concerning that almost 40% didn’t know or weren’t sure.

The work still needed to explain the advantages of digitalisation and the particular details of the new concepts that will come with it was clear from a question on what understanding delegates have on concepts such as the Single Trade Window and Ecosystem of Trust. Here only 11% claimed a strong understanding, with 89% admitting their understanding was weak or non-existent.

Look ahead to 2023

As the final webinars took place in December, we asked delegates to look forward to 2023. Asked specifically what they wanted to see in terms of global trade, 41% opted for simpler rules for trade, 23% for digitalisation of trade processes, 19% for an easing of supply chain challenges, 10% for reduced tariffs and 8% for a greater emphasis on the climate.

In terms of the macroeconomic and geopolitical headwinds facing businesses, it was clear that rising economic uncertainty was the main cause for concern in 2023, cited by 38%.

A further 31% cited post-Brexit trading rules with the EU, and a fifth (20%) pointed to the energy crisis. But there was a strong indication of the resilience of businesses that trade internationally.

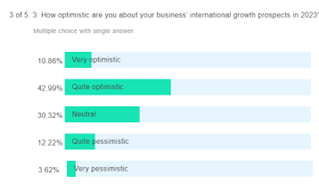

Because despite all these challenges and headwinds, 54% are feeling very (11%) or quite (43%) optimistic for their international growth prospects in 2023. A further 30% claimed to be neutral, with only 16% feeling quite (12%) or very (4%) pessimistic.