The sun is shining bright and, in some parts of the UK, the summer holidays have already arrived.

Minds across the country are now turning towards getting away from the work laptop and onto the beach to relax, recharge and soak in some rays.

Many businesses in the UK hospitality and retail sectors, particularly on the seaside, will be hoping that Brits are considering staycations this year while also anticipating a surge in overseas tourists.

At the IOE&IT, we’re always interested in the trade angle, of course. So, what considerations should importers of summer-related items be making ahead of their next overseas order?

Importance of commodity codes

Since Brexit, importers have been required to complete customs declarations for goods from the EU – something they already needed to do for imports from non-EU markets.

One of the key data elements in a declaration is a good’s commodity code – a number that is unique to the commodity that is used to determine what duties or origin rules, among other things, apply.

The act of determining the correct code for your product is called customs classification. This process can be more complicated than it would at first appear, and the UK government has adopted the WCO’s general rules of interpretation (often referred to as ‘GIRs’) as instructions businesses should follow, in sequence, when trying to classify their goods.

Classifying summer goods

So let’s look at how you could classify some of the most frequently traded summer items if you were importing them into the UK.

This article is for educational and entertainment purposes only. It does not constitute legal advice on any of the commodities included. We would like to thank IOE&IT trade and customs specialist Lyn Dewsbury for her research contribution to this article.

Sun cream

For most goods, it should hopefully be quite simple identifying your goods as you can just follow GIR 1 which effectively states that you can, in the first instance, identify your goods using the section titles, chapters and sub-chapters included in the UK tariff. To support this, the UK has provided an online tool for searching the UK tariff called the UK Integrated Online Tariff.

So let’s try this with sun cream because, with the UK bracing for a hot summer this year, it’s better to be safe than sorry.

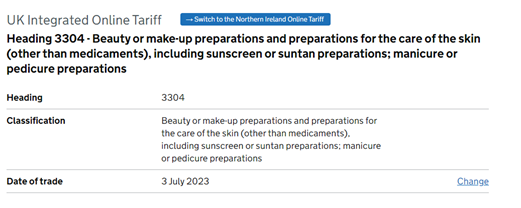

The first thing to consider is that globally traded items might be referred to by their international English names rather than in UK English. So, noting that ‘sun cream’ doesn’t yield any results on the online tariff, try ‘sunscreen’ instead. Hey presto, the following computer screen may appear:

As you delve deeper into the page, you can review the sub-headings, which include ‘lip make-up preparations’, ‘eye make-up preparations’, ‘manicure or pedicure preparations’ and ‘other’. Opening up the ‘other’ sub-heading, you’ll probably determine that ‘powders, whether or not compressed’ isn’t what you’re after, so the code alongside a further ‘other’ is probably the one you need.

The commodity code you may want to use for importing sun cream – or sunscreen – is therefore 3304990000. By clicking into this number, you’ll see a new page which includes all the import, export and origin rules relating to that good, as well as a tab of further ‘notes’ about the good.

On the import tab, you’ll see that a duty rate of 0% is set against pretty much every country, except for those against which the UK currently imposes trade restrictions or sanctions. This is because the UK’s most favoured nation (MFN) tariff – or ‘third country rate’, as it is sometimes referred to on the tariff tool – for sun cream is set at 0% at the WTO. This means the UK cannot discriminate against any other WTO member by setting a higher tariff for imports from that country.

Beach volley balls and beach towels

Using the same methodology as above, you may determine that the commodity code for a beach volley ball is 9506620000. The MFN tariff for beach balls is 2% but a preferential 0% tariff applies for many countries with which the UK has signed and ratified a free trade agreement (FTA).

So, if you’re importing a beach volley ball from Sweden, which is a member of the EU, you will be able to claim a 0% preferential tariff, providing you comply with the rules of origin for your product, as dictated under the EU-UK Trade and Cooperation Agreement.

If you’re importing a cotton beach towel from Egypt, you’ll see that 6302939000 might be the commodity code that would be suitable for your product. Within the tariff, you’ll see that a 12% MFN rate may apply as long as there is supporting evidence.

If you were deciding between importing the towel from Egypt or Germany, this could be an important factor, because the MFN rate applies to Egypt, but for Germany, there is a preferential tariff of 0%.

Sunglasses with plastic lenses in a glasses case

Let’s try one which might be a bit more complicated. If you’re importing sunglasses in a case, you could face the prospect of two commodity codes:

- 9004109100 for sunglasses with plastic lenses

- 4202990090 for a spectacles case

In such an instance, you will need to review the six GIRs and their clauses in sequence until you come to a rule that enables you to determine the correct code.

In this case, you will probably come to GIR 5a which is the rule that applies to a range of different cases that are “specifically shaped or fitted to contain a specific article or set of articles”. The rule states that the case should be “classified with such articles when of a kind normally sold therewith” but that the rule does not “apply to containers which give the whole its essential character”.

In this instance, you can probably say that the “essential character” of the product is the sunglasses within the case. As such, you should classify the combination of the sunglasses and its case with the sunglasses’ code of 9004109100. If you were importing just the sunglasses case, separately to the sunglasses, then GIR 1 would apply and you would use the code 4202990090.

A similar process could be used if classifying a camera (9007100000) in a case (4202990090). If importing the two together, you could use GIR 5a and use the camera’s code of 9007100000.

Sandcastle set (packaged as one item)

Many of the GIRs are used for identifying the import of a product that combines multiple items – for instance, something that comes in a set of multiple goods. So, if you were importing a sandcastle bucket set that includes a plastic bucket, plastic spade and a plastic toy animal of some sort (say a fish), how would you classify it?

The rule which may be of most use here is likely to come under GIR 3, which applies to goods that are “prima facie classifiable under two or more headings”. GIR 3 has three applications, which can be summarised as follows, though please do ensure to read the GIRs in full when doing classification yourself:

- GIR 3a: use “the heading which provides the most specific description”

- GIR 3b: classify according to the “material or component which gives them their essential character”

- GIR 3c: “when goods cannot be classified by reference to 3a or 3b, they shall be classified under the heading which occurs last numerical order among those which equally merit consideration”

The headings for the three parts of the sandcastle set are as follows:

- Plastic bucket: 3923

- Plastic spade: 9503

- Plastic fish: 9503

It’s quite plausible to say that you may need to use 3c to classify this good because, although the plastic fish is probably more of an accessory to the set, the plastic bucket and spade are both “essential” to it and neither gives a more “specific description” of the product than the other.

You might argue otherwise or have enough doubt about the application of 3c that you’re not happy to classify it one way or the other. In such a situation you can apply for an Advance Tariff Ruling (ATR) from HMRC – a legally binding interpretation of the tariff that you can use for three years following it being issued.

Noting that other companies have also been a similar position to yourself, you can search online for other ATRs that have already been issued here. Searching on the database, you will see a range of different results, including ATR 505005991 which recommends to use commodity code 9503007000 for other sets of toys designed for outdoor use by children.

Windbreaker

Hopefully the summer ahead will be warm and still, but we live on an island, so it can get windy. As such, a windbreaker is a must-have for many beachgoers but searching for it in the commodity code comes up with a blank. It’s not the easiest thing to classify, being a sort of tent-like umbrella thing, with lots of poles and textiles.

Fortunately, using the ATR database, using a combination of keywords such as “umbrella”, “textile material” and “for covering”, you’ll see there’s a few different options that could apply to a windbreaker, including rulings 504877237 and 504869431 which both result in the commodity code 6601100000.

Applying for an ATR

It should be stressed that the above suggestions do not constitute legal advice and it is always advisable to get expert advice when doing classification, especially if it comes to using an ATR.

If you receive expert advice to apply for an ATR, you can do so here on gov.uk. You’ll need a Government Gateway account to do this and are advised that it can take between 30 and 120 days for HMRC to respond to your application.