The effects of Brexit on UK exporters over the last 12 months are still evident

UK Exporter Monitor, February 2022

New modelling from the Exporter Monitor produced by data group Coriolis Technologies and the Institute of Export & International Trade shows a pick up in January 2022 of the 12 month average for the number of businesses exporting from the UK compared to December 2021.

The Exporter Monitor also shows that, compared to December 2021, these businesses increased the numbers of people they employed and that their revenues were also higher.

Even so, the picture overall is mixed. As a result of the end of the transition period changing the nature of goods and service movements between Great Britain and the EU so that they became exports, the Exporter Monitor data showed a near-doubling of the number of exporters, and accordingly, their revenues and their employees in February 2021.

This is still working through the data. For example, the increases in January this year compare to major drops in the numbers of exporters in January 2021 as a result of Brexit uncertainty; and while the increase in January this year is welcome, it is insufficient in itself to reverse a downward trend evident since April 2021.

We expect the challenges of continuing pandemic-related supply chain delays and the effect of the introduction of customs disclosures for EU importers into the UK to have worked through by the end of Q1 this year. However the average numbers of exporters, their employees and their revenues are still likely to be lower than they were at the end of Q1 in 2021 when record numbers of companies had just become exporters - some of those companies have since changed they way they operate and ceased to export themselves, although they may be using third parties.

Coriolis Technologies Chief Executive, Dr Rebecca Harding said:

“The data shows that UK exporters are still fragile from the joint shocks of pandemic-induced supply chain shortages and the aftermath of Brexit which caused so many companies to become exporters overnight. Worryingly, it is SME exporters that look most vulnerable in terms of future revenues and further financial support in the form of export guarantees and digital trade should focus on the requirements of these businesses.

Insitute of Export & International Trade director general, Mr. Marco Forgione said:

“Exporters must be congratulated for navigating their way through what has been a year of many challenges. They, particularly those that are SMEs, need more support from Government, to access advice and training to deal with the uncertainty that they face right around the world. The Export Strategy is a good start but this needs to be prioritised right across Government. Looking forward, there is an opportunity in so many UK companies having been introduced to exporting this year. Once they are confident in exporting to Europe, and we believe that is increasingly the case, taking the next step, into global markets need not be so daunting.”

The findings in detail

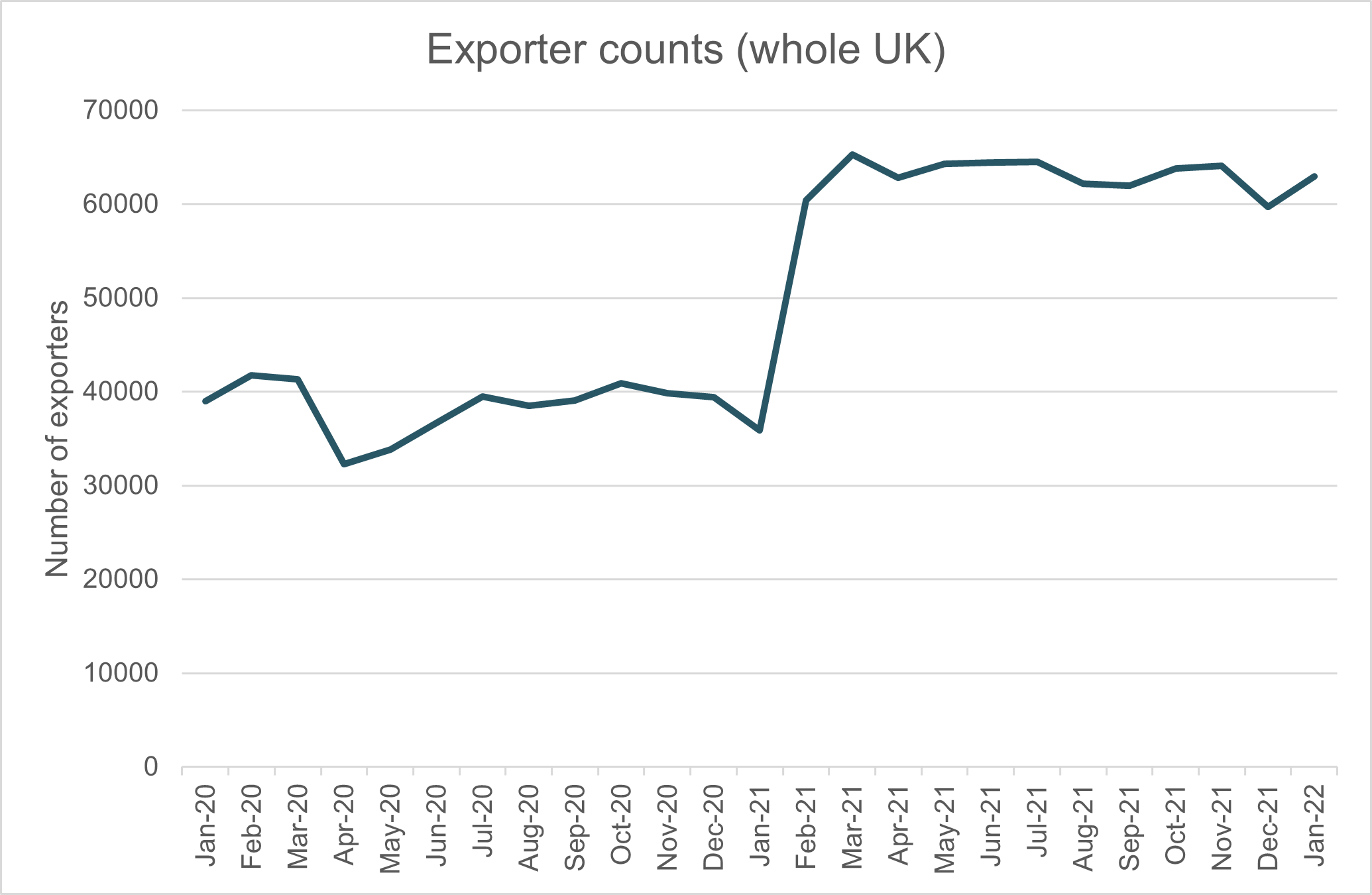

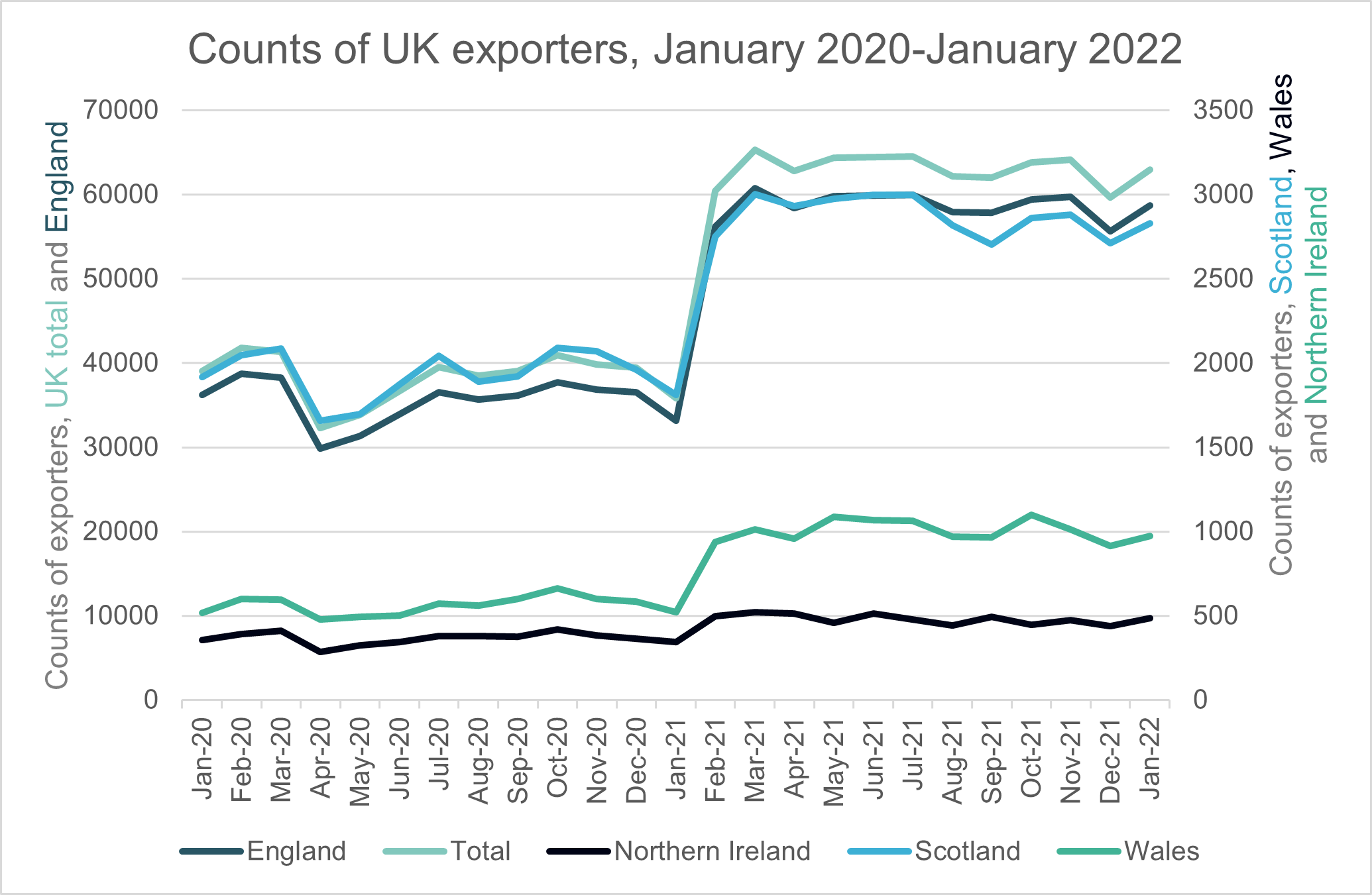

1: There were an average of 62,967 exporters per month in the 12 months to January 2022. This compares to an average of 35,864 exporters per month in the 12 months to January 2021 and takes into account an increase on average of 24,543 exporters per month from February 2021.

Figure 1: Counts of Exporters over time

NOTE: The data for Scotland, Wales and Northern Ireland are given in the Appendix

Wales and Northern Ireland have seen the biggest proportionate increase in the numbers of exporters post-Brexit. They have also appeared to be the most resilient with the declines less substantial since April last year than for Scotland or England.

2: These businesses employed on average 12,938,795 (nearly 13m) people per month over the past 12 months to January 2022. This compares to 9,409,215 in the 12 months to January 2021 taking in an increase on average of 4,438,787 additional employees from February 2021.

Figure 2: Exporter employment over time, January 2020-January 2022

NOTE: The data for Scotland, Wales and Northern Ireland are presented in the appendix

Wales and Northern Ireland saw the number of employees in exporting businesses fall back in January 2022 by over 5% and nearly 1% respectively.

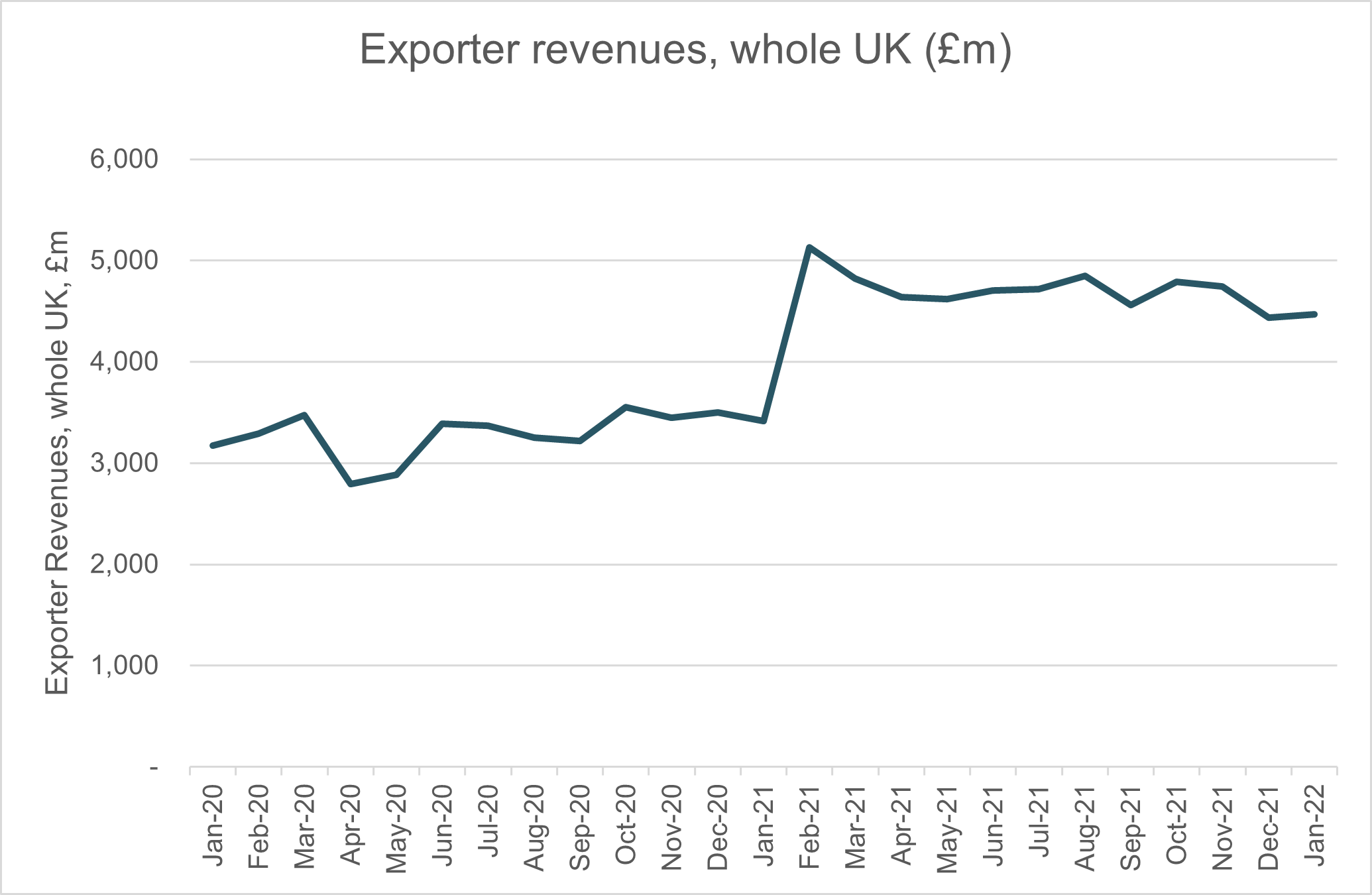

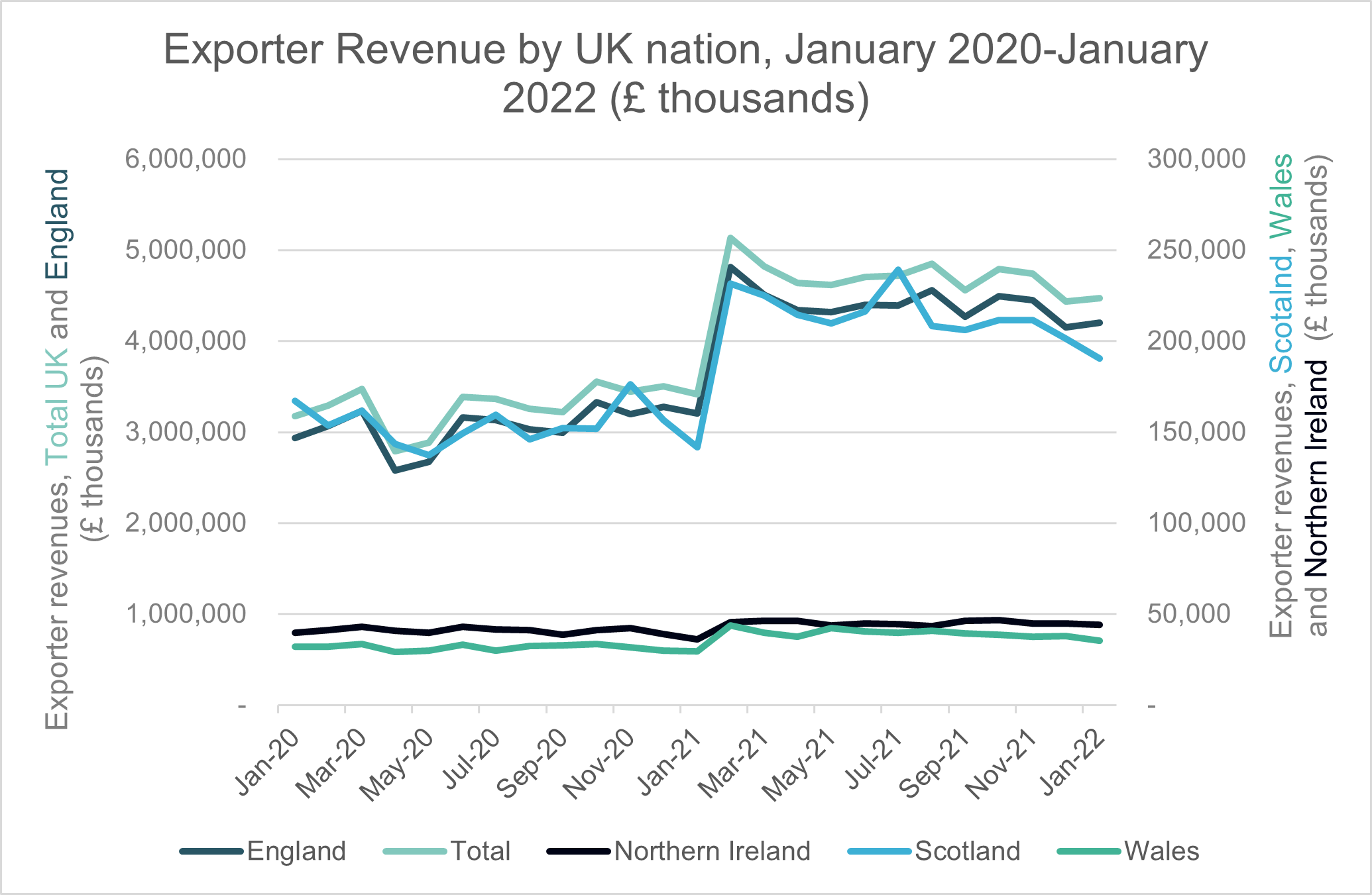

3: Over the last 12 months to January 2022, exporting businesses contributed a total of nearly £5bn per month in revenues to the UK economy. This compares to an average of £3.4bn in the 12 months to January 2021 and takes into account an increase of £1.7bn from February 2021.

Revenues declined in all UK nations except England in January 2022 compared to December 2021.

Figure 3: Exporter revenues over time , January 2020-January 2022

NOTE: The data for Scotland, Wales and Northern Ireland are presented in the appendix

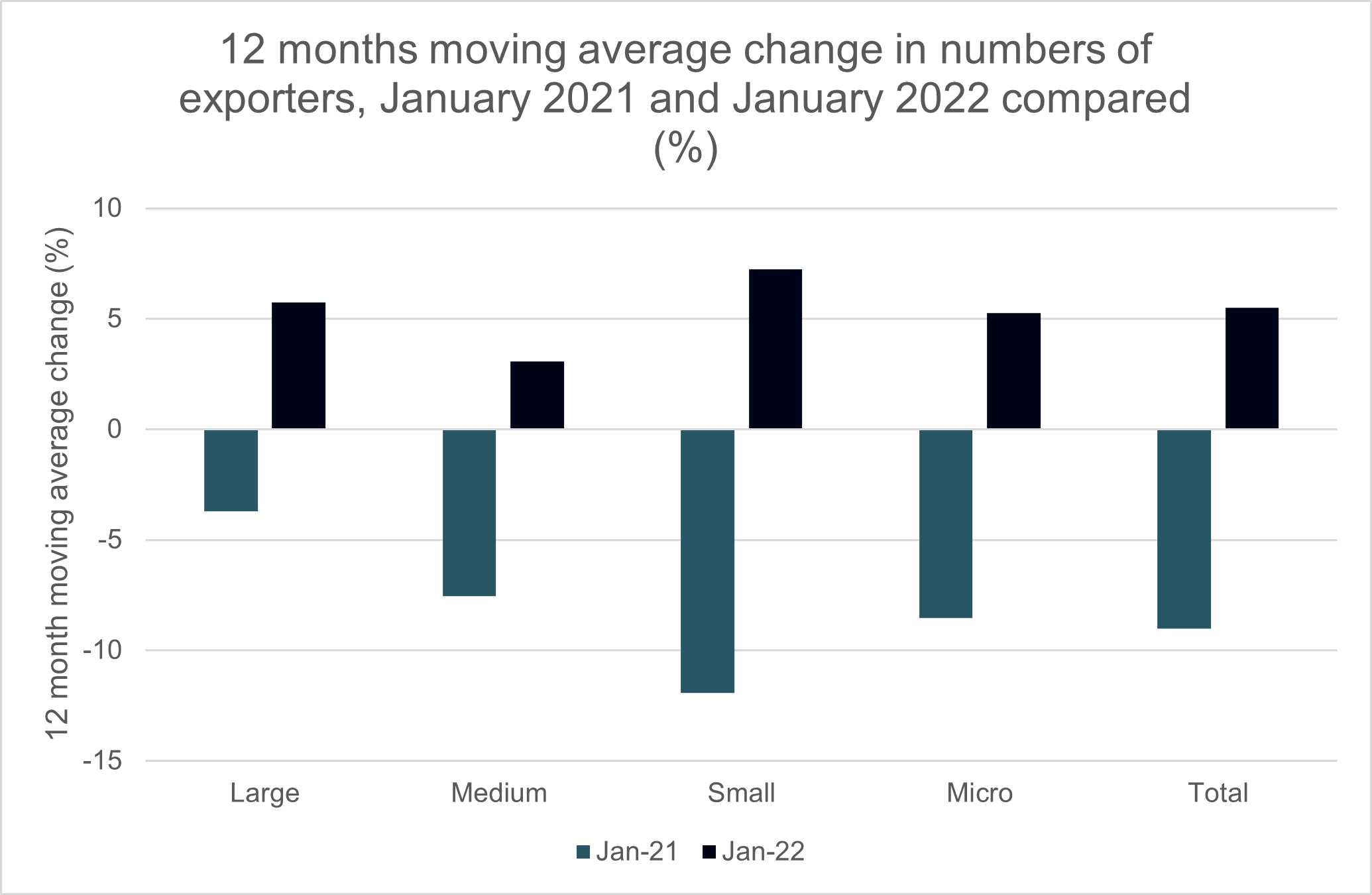

4: The 12 month moving average number of exporters grew in January 2022 by 5.5%. This compared to a drop of 9.2% in the number of exporters in the 12 months to January 2021. The growth was particularly strong in small exporting businesses, not least because these were also the ones that were hardest hit in December 2021 by supply chain shortages.

Figure 4: 12 month moving average change in exporter numbers (%)

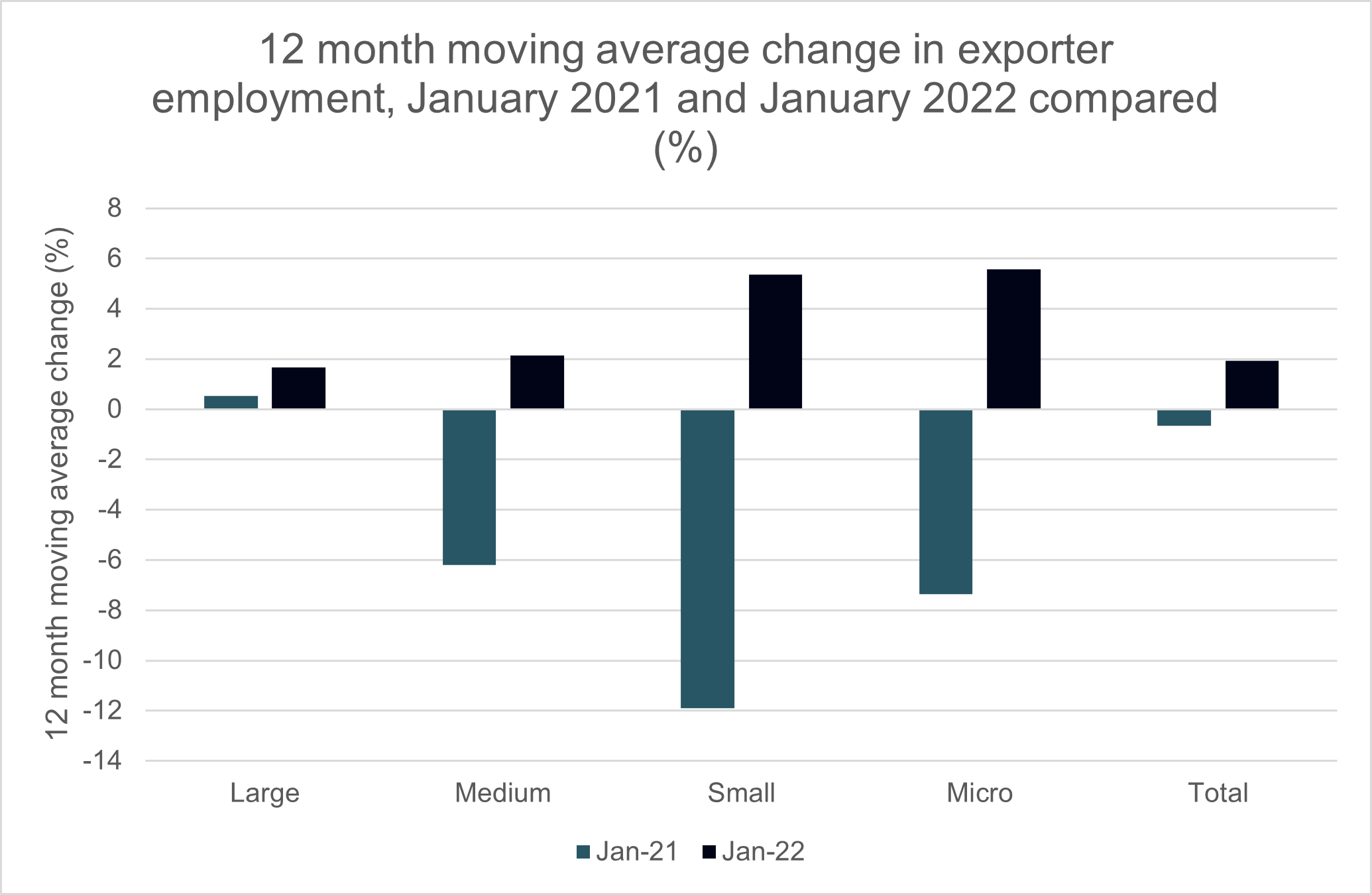

5: The number of employees in UK exporting businesses grew by 1.9%. This compares to a drop in employment in January 2021 of -0.65%. Small and micro businesses saw the biggest 12 month moving average increase in their employment, although they were also the businesses that were impacted most 12 months ago with changes to customs declarations.

Figure 5: 12 month moving average change in exporter employment

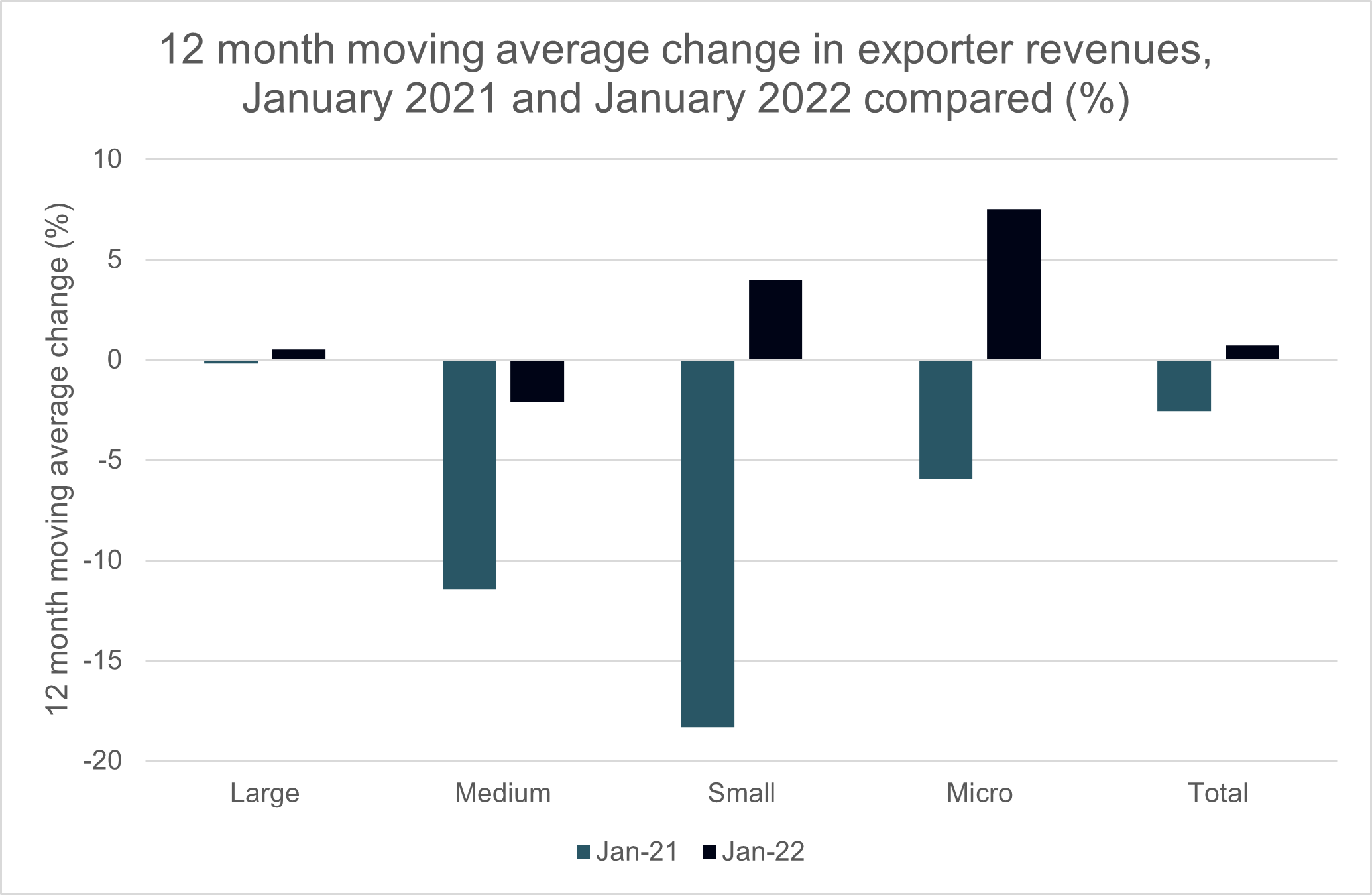

6: The amount of revenue generated by exporting businesses grew by 0.7%. in the 12 months to January 2022 grew by 0.7% . This compares to a drop in revenues in the 12 months to January 2021 of 2.6%. Medium sized businesses saw their revenues fall back by 2%, which is attributable to on-going supply chain issues affecting both imports and exports.

7: We expect the 12 month moving average number of exporters to fall back in February 2022 to fall back by over 4% and the average number of people they employ to decline by 0.7%. However, we also expect revenues to increase by over 4% into February. This is accounted for by a large increase in revenues for the largest exporting firms who have been streamlining their operations over the past 18 months by reducing employment numbers while increasing revenues.

Methodology

- Coriolis Technologies has matched UK exporter data from Customs and Excise sources with Bill of Lading data and large-scale publicly available datasets. UK HMRC data covers the names and addresses of all UK exporters who send products through customs and excise. These names were matched to Bureau van Djik FAME data to establsh turnover and employment levels. To establish the numbers of service sector companies with export revenues, Coriolis took those businesses in the FAME database with international turnover to collect sector and employment as well as turnover information. The sector distribution of exporters in goods and services was then applied to the sample of companies which did not have turnover or employment data to scale the whole dataset to establish counts, turnover and employment for the UK as a whole. Companies were taken from an HMRC sample going back to 2017 and any duplicates with international turnover data from FAME data removed.

- The forecasts are based on a statistical “General Additive” modelling framework which decomposes each time series (each exporter count group) into a couple of main components:

- trend

- seasonality - effect of calendar month or season

- changepoints - moments where the trend shifts

- special calendar events

- These effects are smoothed, added together and extrapolated into the future to create forecasted values for each exporter group separately. The model is optimized to explain as much variability in the time series with as simple model as possible.

- The estimated forecasting error is within 1.7% of the actual value, back-tested on the actual forecasting performance over the past 2 years for the aggregate forecasts and for the forecasts by size and UK nation

Additional data

Figure A-1 : UK exporter counts by UK nation, January 2020-January 2022

NOTE : data is presented for England on the left hand vertical axis, and for Scotland, Wales and Northern Ireland on the right hand axis for ease of trend comparison

Figure A-2 : UK exporter employment by UK nation, January 2020-January 2022

NOTE : data is presented for England on the left hand vertical axis, and for Scotland, Wales and Northern Ireland on the right hand axis for ease of trend comparison

Figure A-3 UK exporter revenues by UK nation (£m), January 2020-January 2022

NOTE : data is presented for England on the left hand vertical axis, and for Scotland, Wales and Northern Ireland on the right hand axis for ease of trend comparison

About Coriolis Technologies

Founded in 2017, Coriolis Technologies is the leading source of trade, corporate, geopolitical risk and trade-related economic data globally for the trade finance sector. Coriolis Technologies provides clear intelligence and insight into trade flows, supply chains and disruptions for trade and trade finance.

About the Institute of Export & International Trade

The Institute was established over 85 years ago to support UK businesses in growing their international markets and trade. The Institute is the leading association of exporters and importers providing education and training to professionalise the UK’s international traders.