Written by Jim Davis, Managing Director for Export Finance - Bibby Financial Services (Corporate Members)

A year ago, we undertook research to learn about the challenges facing established SME exporters – there were many. Those challenges have not gone away and are, if anything, more pressing than ever for SMEs looking to grow and thrive on the global stage.

Where were we?

In February 2017, Secretary of State for International Trade, Dr Liam Fox, abandoned the Conservative Government’s long-standing target of doubling UK exports to £1 trillion by 2020. While opponents and other parties pointed the finger at Brexit, the Government said that slowing global growth was to blame.

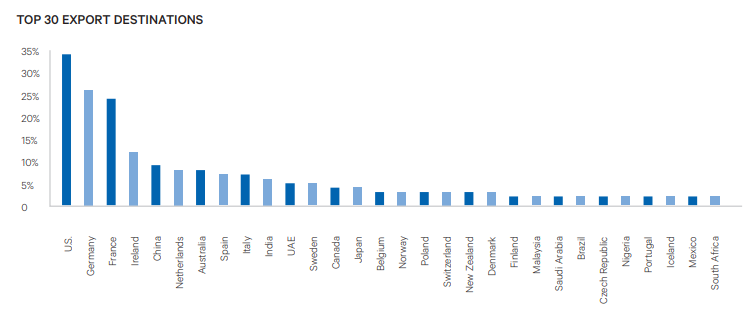

At the time, there was a strong argument to be made that Brexit would have significant impact on UK exports, with half of the top 20 export destinations for SMEs being within the European Union. However, there were others including the US, China, and Australia, who painted the picture of a global outlook.

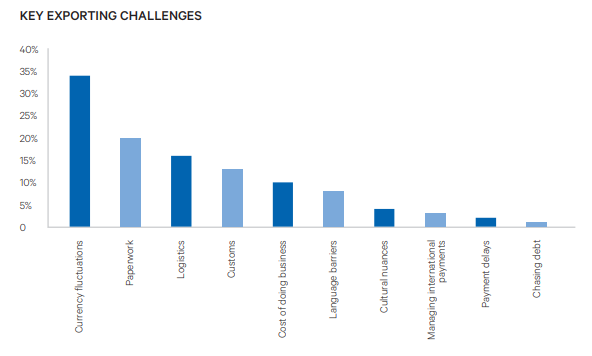

While it was expected that a weaker pound would make UK exports more competitively priced, this was offset for many SMEs by both more expensive imports and currency volatility. In fact, (34%) said at the time that currency volatility was the greatest challenge they faced. So, whilst a weak pound may have had a positive impact, the uncertainty certainly didn’t help SMEs manage their currency costs or importing foreign goods and services.

Additionally, the increased administrative requirements were a significant concern for one in five (20%) SMEs. Export licences, customs declarations and VAT invoices are just a few examples of the types of paperwork required for businesses to decrease risk, comply with legislation and avoid delays in shipping or delivery.

SMEs certainly weren’t exuding confidence but did that expectation become a reality?

Where are we?

The ONS figures from November 2017 – November 2018 paint a slightly more optimistic picture. The number of SMEs exporting to overseas markets increased by 6.6% to 232,000 (9.8% of all SMEs), while large businesses exporting increased by 6.1% to 3,500 (41.7% of all large business). Overall, the UK’s total exports have grown by 4.4% year-on-year, to £630bn in November 2018.

When the figures were released in January, Dr Liam Fox MP, the Secretary of State for International Trade, issued a statement talking about how the UK Export Strategy “sets out an offer to every business that has the ambition to start exporting or increase their existing operation”. He also stressed the Government’s new target to increase exports as a percentage of GDP from 30% to 35%. The new target, while positive, is a far-cry from the £1 trillion they were previously aiming for.

It is positive, and it is a move in the right direction, but these results mean that a staggering 90.2% of UK SMEs still don’t export.

How do we move forward?

So why don’t more SMEs take advantage of the growth opportunities available through international trade? There isn’t a simple answer to this question. Neither is there a silver bullet that will encourage businesses to consider connecting with new suppliers or finding new customers overseas without de-risking the process entirely.

As negotiations between the UK and the EU rumble on, SMEs of all shapes and sizes remain uncertain about the future. While some believe that necessity is the mother of invention, presenting opportunities to forge trading partnerships further afield, others predict that a future outside of the world’s second largest economy could have a negative impact on their businesses.

SMEs will have to adapt to the new environment in which they operate by rethinking how they can develop new business, focus on profitability and find operational efficiencies. The exporters we speak with are looking to cut costs and grow profits, and this includes looking more closely at the strategic opportunities in the countries where they already operate, as well as considering new markets offering better value imports and exports.

We’ve worked with thousands of exporters and the one common thread amongst those that have been successful is leveraging the support available, both from the private and public sector. Bodies such as the Institute of Export offer strong guidance for UK SMEs exporting goods and these resources are worth tapping into. Equally, seeking support from the private sector around common issues such as cashflow, payment collection and languages can pay dividends.

Graphs and Bibby Financial Services research referenced in this blog refers to the “Trading Places Report” published by BFS in December 2017. The full report, including our methodology, is available online at the following link: https://www.bibbyfinancialservices.com/about-us/news-and-insights/reports/2017/trading-places