One year on from the UK’s referendum vote to leave the EU, plenty has happened. We’ve gone back to our members and fellow exporters to track their views, attitudes and desires around Brexit in another survey.

The key points from last year’s survey – held in the weeks following the referendum – included the desire from the export community for continued access to the single market and concerns about changes to tariffs, duties and customs. This year’s survey – for which we had over 200 respondents – indicates that little has changed in terms of what exporters want from Brexit and what they are most concerned about.

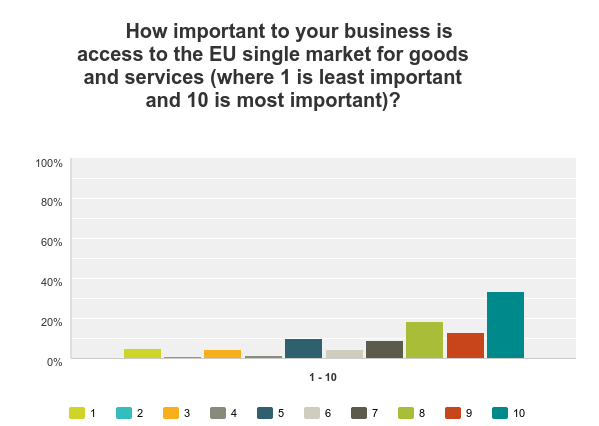

Access to the single market of the utmost importance

In response to the question ‘How important to your business is access to the EU single market for goods and services?’ on a scale of 1-10, 73.76% said it was above 7 in importance. 33.66% rated it a 10, which is actually down slightly from last year where this was just under 50%, but it is still abundantly clear that our members and followers value the single market greatly.

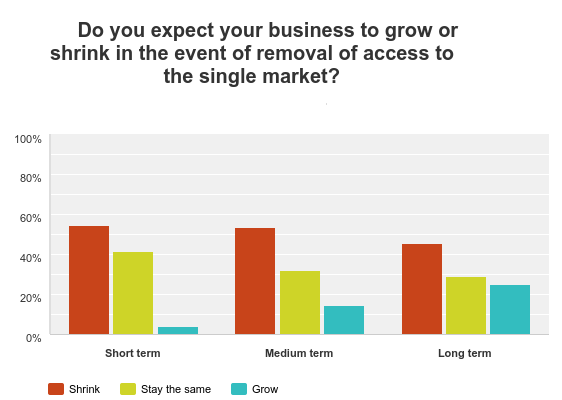

54.46% of respondents expect their business to shrink in the short-term, with 53.47% saying the same in the medium-term, and 45.54% for the long-term. This is similar to the response when this question was asked last year, where 47% expected a medium-term shrink and 42% a long-term growth decline.

25.25% of respondents to this year’s survey expect long-term growth, with 41.58% seeing no change in the short-term.

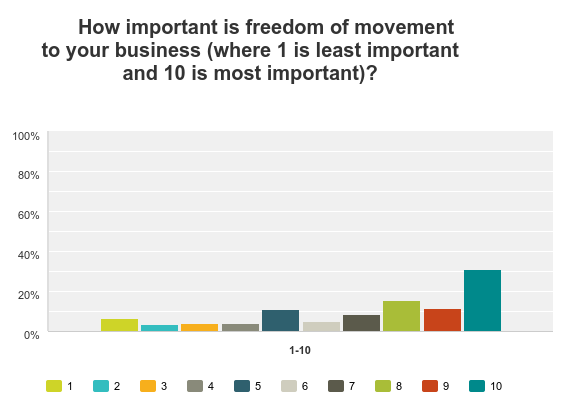

Freedom of movement also important

Like the single market, freedom of movement was also viewed by respondents as being important for their ability to do business. 66.35% rated the importance as between 7 to 10, with 31.19% giving it a 10 rating.

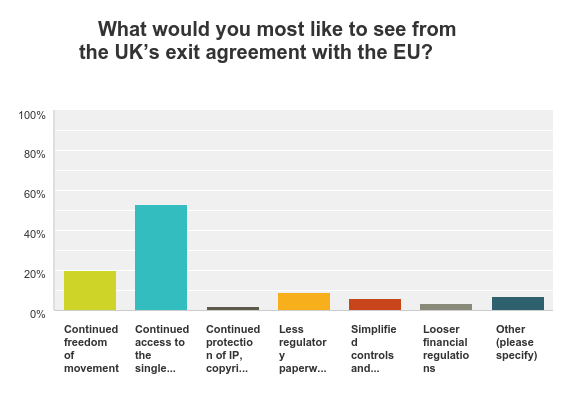

Priorities for government

These findings were vindicated by the response to a question asking about what the government should prioritise in its negotiations for leaving the EU. Here, 52.97% said they would like access to the single market to be maintained, followed by 19.80% prioritising freedom of movement, and 8.91% asking for less regulatory paperwork and compliance.

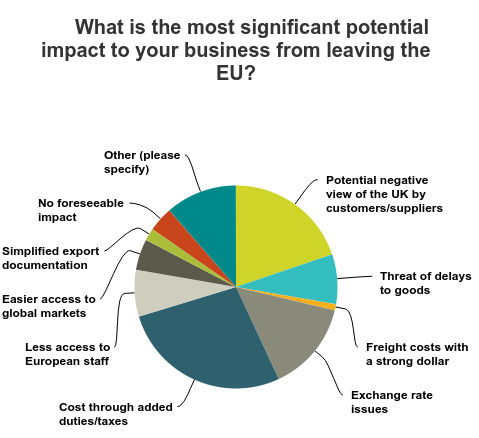

When asked what else would affect their ability to do international business, 27.23% said that added cost through added duties and taxes would have an impact, with 19.8% concerned about suppliers having a negative view of the UK.

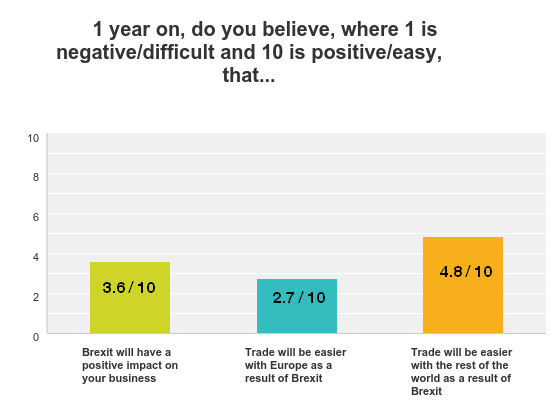

Pessimism in the short, medium and long term

In response to a similar 1–10 question – where 10 is positive - respondents were pessimistic about the impact of Brexit on their ability to do business generally. 65.41% rated the impact as 1-4 and only 15.46% rated this 7-10. 78.63% said doing business with Europe will be more difficult with ratings of 1-4.

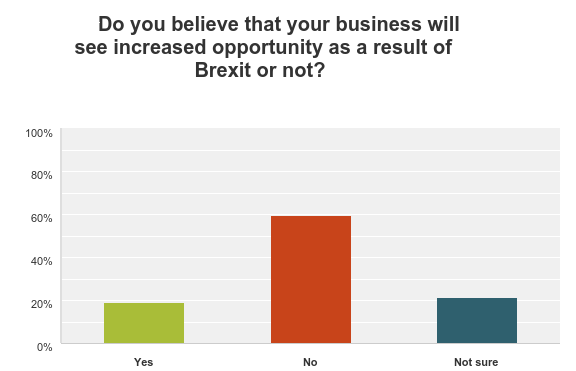

When asked more generally about whether Brexit will see an increase in opportunities for doing business, 59.55% said no with 19.09% saying yes (21.36% not sure).

The outlook for doing business with the rest of the world was less negative but pessimistic nonetheless. 40% gave a rating between 1 and 4 when asked about the impact on doing business with countries outside of the EU, with 18.81% giving a positive rating between 7 and 10.

Continued trade relations with the EU and a deal with the US wanted

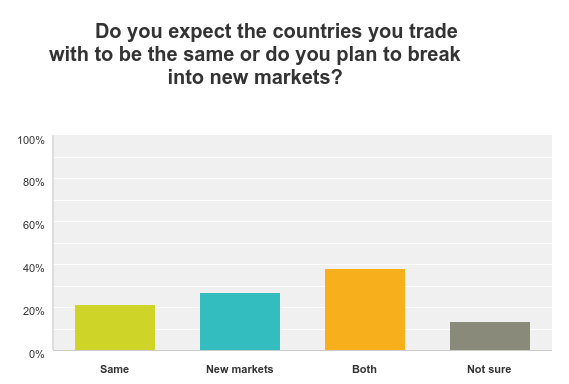

In terms of the impact on which markets respondents see themselves doing business in following Brexit, 27% said they expect to be trading with new markets, 31.5% anticipating no change, and 38% saying they’ll be trading with both new markets and the same markets that they are already exporting too. This indicates that the idea of a more Global Britain may be starting to trickle through to UK exporters.

In terms of potential new free trade agreements upon leaving the EU, in the short-term 67% prioritise doing a trade deal with the EU itself with the USA in second at 17.5%. 42.5% prioritise the EU again in the long-term with the USA again second at 30%.

Businesses are planning for Brexit

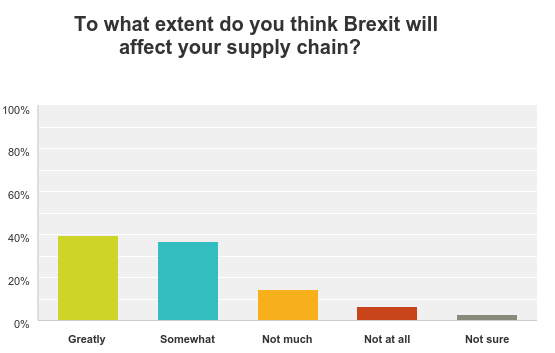

Most companies believe their supply chains will also be affected by Brexit, with 39.6% saying it will be greatly changed and 36.63% saying it will be somewhat changed.

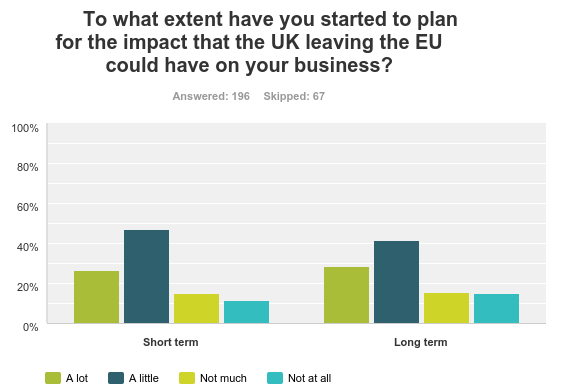

By and large, though, businesses are starting to plan for the potential different outcomes of Brexit in both the long and short terms. Only 26.53% say they haven’t planned at all or not very much in the short term, and only 30.11% say the same in the long-term.

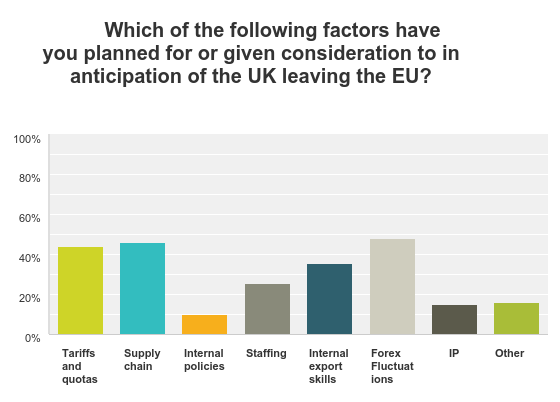

The majority of respondents (88.57%) have started to plan for the impact that the UK leaving the EU could have on their business are planning for changes to tariffs and quotas, with 45.92% planning for changes in their supply chains and 43.88% planning for foreign exchange fluctuations. The Institute is encouraged that 35.71% are planning on increasing their internal export skills and hopes to see this number go up over the coming years.

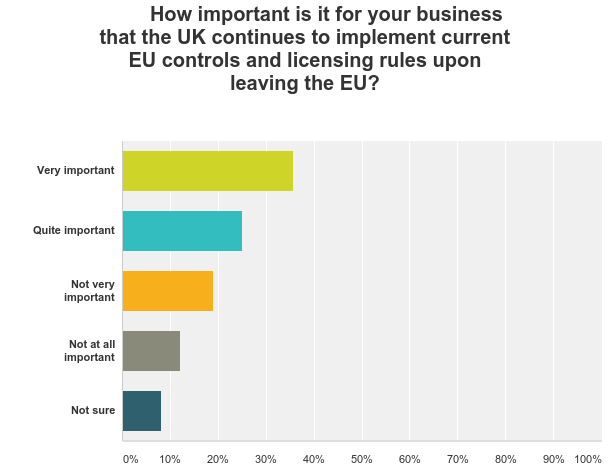

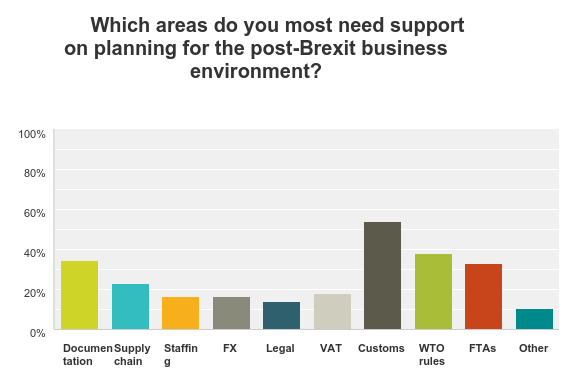

In response the question ‘Which areas do you most need support on planning for the post-Brexit business environment?’ 52.08% said they needed support on customs, controls and licensing. Companies are keen for support on understanding WTO rules and how FTAs work (37.76% and 33.16%) and, unsurprisingly in lieu of this, 35.69% say they need support with export documentation.

A divisive issue causing uncertainty

Brexit undoubtedly remains a divisive issue for our members and there were plenty looking to embrace the opportunities that could come with leaving the EU. When asked about the potential primary opportunities that Brexit could create, respondents often suggested less regulation, a changed currency landscape, less influence from ‘non-elected EU bureaucrats’, and increased access to non-EU markets as potential boons.

One respondent said: “It will enable the UK to view Europe as the regional association it is and our associations within Europe as part of a far wider global context in which we can focus on our partners in the USA, Commonwealth, the rest of the world and Europe, rather than seeing the EU as our primary relationship.”

Prevailing uncertainty is another key concern from respondents, however, with many saying that they cannot identify the impacts of the post-Brexit environment until they know answers to important questions regarding aspects of the negotiations such as the single market and the trade deals that the UK may go onto negotiate.

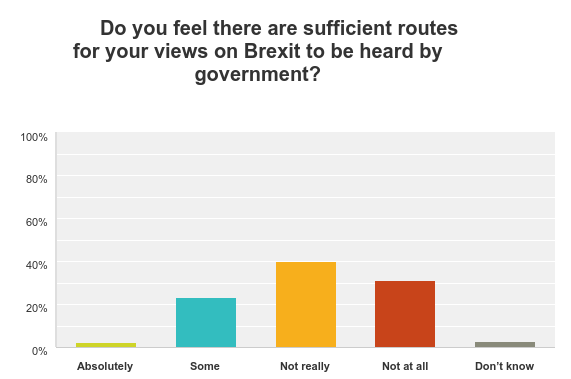

Worryingly, 71.29% said there aren’t sufficient routes for airing their view on Brexit to the government - 31.19% saying ‘not at all’ and 40.10% saying ‘not really’ when asked.

The Institute's support for Britain's exporters

The Institute will of course continue to do all it can to represent our members’ concerns about Brexit to the government, as well as those of the wider export community.

For support on planning for the different potential outcomes, you can sign up to our Post Brexit Planning workshops or watch our Open to Export webinar on 'What exporters need to know about Brexit in 2017'.