A year on from our inaugural Export Optimism Survey, UK businesses remain fairly confident about the state of global trade, but continued Brexit uncertainty, the threat of trade wars, and strained political relations with Russia have all taken their toll.

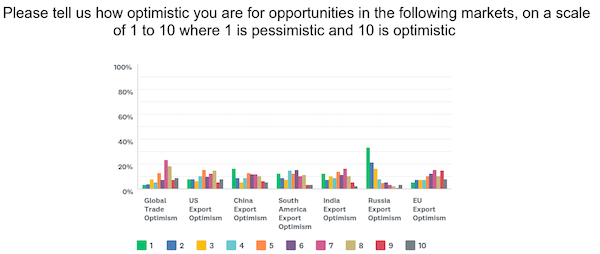

58.54% of respondents gave a 7 or more out of 10 when asked about optimism for global trade generally, with 49.18% scoring the same for trade with just the EU. However, the figure for people scoring their optimism at 5 or more was 78.87% for global trade generally, and 72.14% for the EU.

Beyond the EU optimism wasn’t too high, with 40.99% scoring 7 out of 10 for the USA, 47.16% for China, 28.7% for South America and 35.25% for India.

Optimism for trade with Russia was staggeringly low, with only 9.84% scoring 7 or more out of 10, with only 20.5% saying 5 or more. A massive 54.92% of respondents gave 1 or 2, with 33.61% scoring 1 and 21.31% scoring 2.

Brexit impact

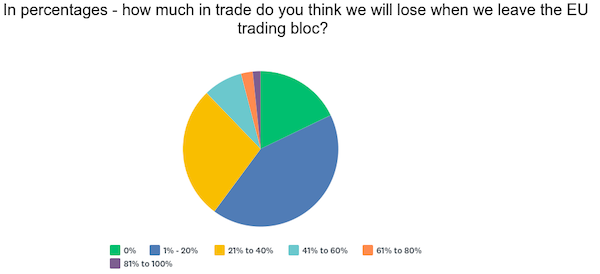

The impact of Brexit being anticipated by our respondents remains about the same as last year, with 82.11% predicting some impact compared to around 87% last year, with just under 18% predicting no impact compared to 13% last year. Only 12.2% predict over 40% or more of trade with the EU being lost.

Many respondents did voice fears about Brexit and said that the continuing uncertainty around it is impacting their ability to plan ahead, saying:

“We are seeing a slowdown in investment as companies concentrate on key international activities over new markets outside the EU - this is not what we had expected and it hails from lack of confidence generally in the way the government is handling Brexit, especially over the Customs Union”

When asked what their biggest concern was around Brexit, many respondents included Brexit – especially our future customs relationship with the EU – but others included currency fluctuations, the troubled UK-Russia political relationship, and the threat of trade wars.

Planning ahead

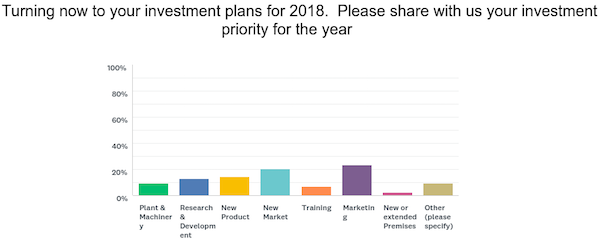

Looking ahead, companies are looking to spread their wings and reach new customers in new markets. 23.28% said they were planning to invest in marketing, with 20.69% looking at new markets. Of concern, given the potential impact that leaving the EU without a customs arrangement in place would have on businesses, is that only 6.9% are looking to invest in training.

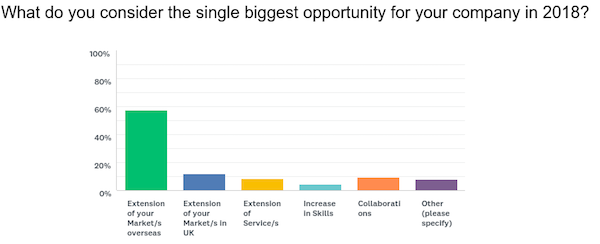

This is mirrored by responses to a question about what businesses see as their biggest opportunity in 2018. 57.39% are looking to extend their markets overseas, with only 4.35% looking to increase their internal skills.

One respondent said:

“It has to be extensions of our markets overseas, but we have been global traders for 20 years. We have always touted UK technical skills, but we are definitely feeling a slight cooling towards us. Can I say we’re 'considered as having less clout' than we used to?”

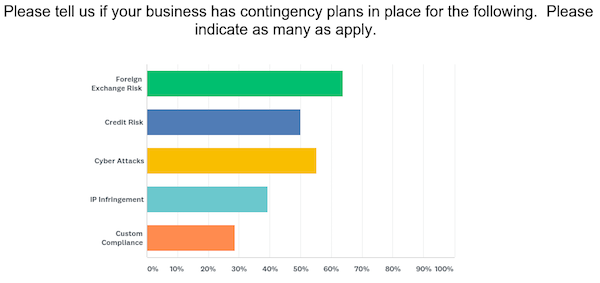

And in terms of where businesses are creating contingency plans for the year ahead, mitigating foreign exchange risk remains on top (63.83%), with cyber attacks (55.32%) and credit risk (50%) following.

Only 28.72% have contingency plans for customs compliance – something which may be affected in a year or two’s time, once we know the UK’s future customs arrangement with the EU.

“What do you consider to be your biggest concern regarding international sales in 2018?” Our respondents reply:

- We do not implement Brexit hard enough or fast enough

- Continued market downturn in Oil industry

- The fluctuation in foreign exchange due to market instability.

- Finding the right skills

- The Pharmaceutical manufacturers in UK do not allow UK wholesalers to export medicines outside UK and with Brexit, Govt wants us to focus on export. Pharmaceutical manufacturers and MHRA need to relax regulations and allow UK wholesalers to export the medicines outside UK

- Post Brexit tariffs and restrictions to the free movement of goods

- Russia - US/UK relations and the global fallout

- Restrictions imposed on trade as a result of Brexit or US protectionism

- We operate in a niche market where clients around the globe buy from UK Auction rooms and need our services to pack and ship their purchases so we do not feel any concerns as demand is growing if anything.

- Lack of clarity over the UK position in the EU customs union. Buyers, agents and partners are asking for greater security from UK brands to de-risk the issues around the UK - sterling, customs union. This is not unique to EU contacts. Our international reputation is being tarnished and there is a perception that the government is not doing enough fast enough both, within DIT and with EU partners

- Lack of funding for DIT assistance if EU grants are no longer available

- The America first policy of the US administration has lost us business in the USA

- 1) EU bias against UK Businesses resulting from Brexit. 2) Trending on domestic trade protectionism in major economies, and 3) Finding grounds to compete with on international stage - historic reputation as an innovating nation is not sufficient

- Tariffs. But it’s the same for every Company. Once out of the EU the brakes are off. We are extending our export markets at present. No big concerns.

- Uncertainty over Brexit. Will lack of confidence in the overall direction of the UK spill over into other markets internationally?

- How soon we will need to open an office in the Benelux to continue trading in some areas. We will not move staff, but we will virtually relocate some of our activities, which will be expensive.... more BREXIT costs!

- Perception from clients in the EU impacted by Brexit of their willingness/ preparedness to continue engaging with us for Research projects and business award

- Brexit obviously plays a part, but the biggest risk for us is how the US views our main markets. China and Asia are the fastest growing markets, closely followed by the Middle East. Continuing uncertainty with regards to Risk and Regulations/Sanctions makes it difficult for us to manage our markets, especially as our products have large US content. Looking at ways to reduce our trade compliance risk, by changing our product contents has got to be high in our future plans

- Attitudes to the UK market and ease of ordering and shipping goods, without trade barriers

- Global belief in Free Trade