Source: Bibby FInancial Services

The UK’s SMEs are being paid late and have written off tens of thousands of pounds six months into the Covid-19 crisis, new research has shown.

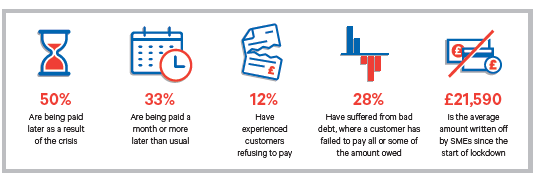

A survey of 500 small firms by market research company Critical Research, on behalf of Bibby Financial Services, shows a half of the country’s SMEs are receiving payments later than usual due to the crisis, with a third saying they are being paid over a month late.

This is an increase on Bibby’s previous report in April this year when a third of respondents said payments were taking longer than normal.

Over a tenth (12%) of firms admitted they are withholding payment to suppliers.

Write-off

The pandemic has resulted in companies writing off an average of more than £21,000.

Over a quarter (28%) have said they have suffered from bad debt, where a customer has failed to pay the full amount owed. Over a tenth (12%) have experienced companies refusing to pay at all.

Supply chain disruption

A fifth of companies are also experiencing supply chain issues due to temporary or permanent closure of suppliers, while one in five say they are using debt to maintain cash flow levels.

Other key findings include:

- Over a tenth (14%) lack working capital to buy raw materials and fulfil new orders

- Roughly the same (13%) amount have turned down new orders because they couldn’t fulfil them

- Almost a third (32%) say social distancing measures continue to reduce their capacity to take on new business

Almost two fifths (37%), however, reported that they have not experienced any challenges due to the pandemic.

Insolvency timebomb

Ana Boata, head of macroeconomic research at Euler Hermes, calls the situation an “insolvency timebomb” in the report.

“Even as economies emerge from lockdowns, we expect the bulk of insolvencies is still to come, largely between the end of 2020 and H1 2021,” she said.

Invoice financing a solution

Bibby’s chief executive, David Postings, said companies need to look at invoice financing as a solution to managing cash flow during difficult periods.

“It is really sad that SMEs are leaving work on the table when the country needs them firing on all cylinders,” he said. “Invoice finance is a critical tool in helping SMEs to manage their cash flow and smooth out the degradation in payment practices that they are facing.”

You can view the full report here.